Mastering Personal Finance: From Budgeting to Investment

Learn how to navigate personal finance with ease and start investing wisely.

Understanding Personal Finance: The First Step

Welcome to the world of personal finance! It's a journey that can sometimes feel overwhelming, but with the right mindset, you're more than capable of mastering it. Whether you're just starting with a budget or curious about investing strategies, my goal is to guide you along the way. Let's dive into understanding and organizing your finances.

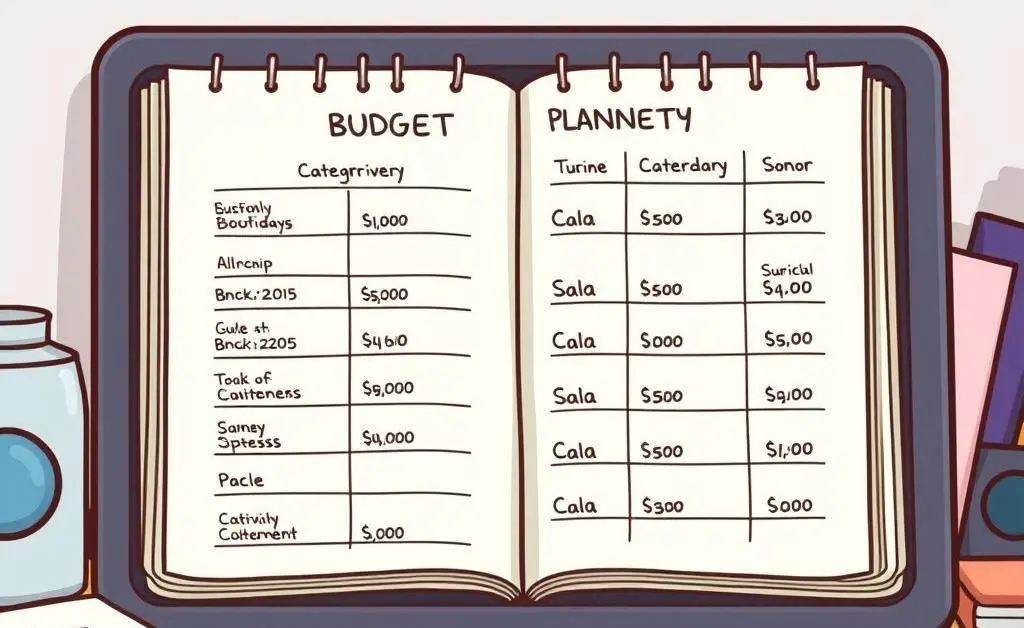

Why Budgeting is the Foundation

Creating a budget is the cornerstone of personal finance. It helps you track where your money goes, ensuring you're spending less than you're earning. Start by listing all your sources of income and expenses. Categorize your spending to see where you might cut back if needed.

Building an Emergency Fund

An emergency fund acts as your financial safety net. Aim to save enough to cover three to six months of living expenses. This prepares you for unexpected events like medical emergencies or job loss. You can start small—consistency is key.

Stepping into Investments

Once you have a budget and emergency fund, consider investing. Whether through stocks, bonds, or mutual funds, investing helps your money grow over time. Remember, the earlier you start, the better due to the power of compound interest.

Setting and Reaching Financial Goals

Setting financial goals gives you a roadmap to follow. Whether it's buying a home, saving for a vacation, or planning retirement, clear goals help you stay focused and motivated.

Conclusion: Your Financial Journey

Every financial journey is unique. By starting small, staying consistent, and being patient, you'll find managing personal finance not only manageable but rewarding. What's your next financial goal?