Mastering Personal Finance: Your Guide to Smart Money Management

Learn practical tips for managing your finances effectively and confidently.

Why Personal Finance Matters

Hi there! Have you ever felt overwhelmed by finances? You're not alone. Understanding personal finance is crucial for living a confident and stress-free life. It empowers you to make informed choices about spending, saving, and investing.

How to Create a Budget That Works

Budgeting can feel like a daunting task, but it's the cornerstone of financial stability. Start by tracking your monthly income and expenses. Use categories such as rent, groceries, entertainment, and savings. This simple act helps uncover spending habits that might need adjusting.

Tools That Make Budgeting Easy

These budgeting apps are designed to help you stay on track and meet your financial goals.

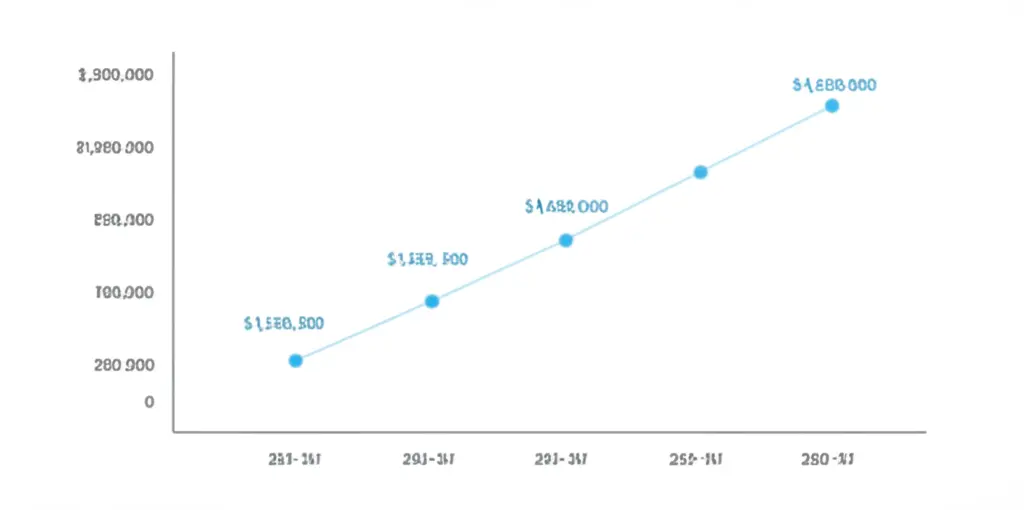

The Power of Saving and Investing

Once you've nailed down your budget, it's time to think about saving and investing. A general rule of thumb is to aim for a savings rate of at least 20% of your income. This ensures you have a solid foundation for unexpected expenses and long-term goals.

Building an Emergency Fund

An emergency fund is your first line of defense against financial shocks. Start with a goal to save $1,000, then work towards three to six months' worth of living expenses.

Smart Debt Management

Debt isn't always bad, but it's crucial to manage it wisely. Prioritize high-interest debts first, such as credit cards. Consider strategies like the snowball or avalanche methods to systematically tackle your debt and see progress quickly.

Conclusion: Taking Control of Your Financial Future

It's time to take charge of your finances. Whether you're budgeting, saving, or investing, each step you take brings you closer to financial freedom. Remember, it's a journey—one that pays off with peace of mind and a secure future. What's the next financial step you're excited to tackle?