Mastering PMI: What It Is and How You Can Avoid It

Discover the ins and outs of PMI and learn practical ways to avoid it.

Ever asked yourself, "What is PMI and why does it feel like an extra tax on my dream home?" You're not alone. PMI, or Private Mortgage Insurance, often seems like an unwelcome guest at the closing table when buying a house. While it’s designed to protect lenders, it can feel like you're the one picking up the tab. But fear not, savvy homebuyers have options!

Understanding PMI: The Basics

Let's break it down. PMI is a type of insurance that lenders require from homebuyers who put down less than 20% on a home. This insurance protects the lender in case you default on your loan. Sounds fair on paper, but in reality, it's an extra cost that can add hundreds of dollars to your monthly bill.

Why Homebuyers Want to Avoid PMI

Most folks are eager to avoid PMI because, frankly, it doesn’t benefit them directly. It’s money out of your pocket without a tangible benefit to you, similar to paying for someone else's car insurance!

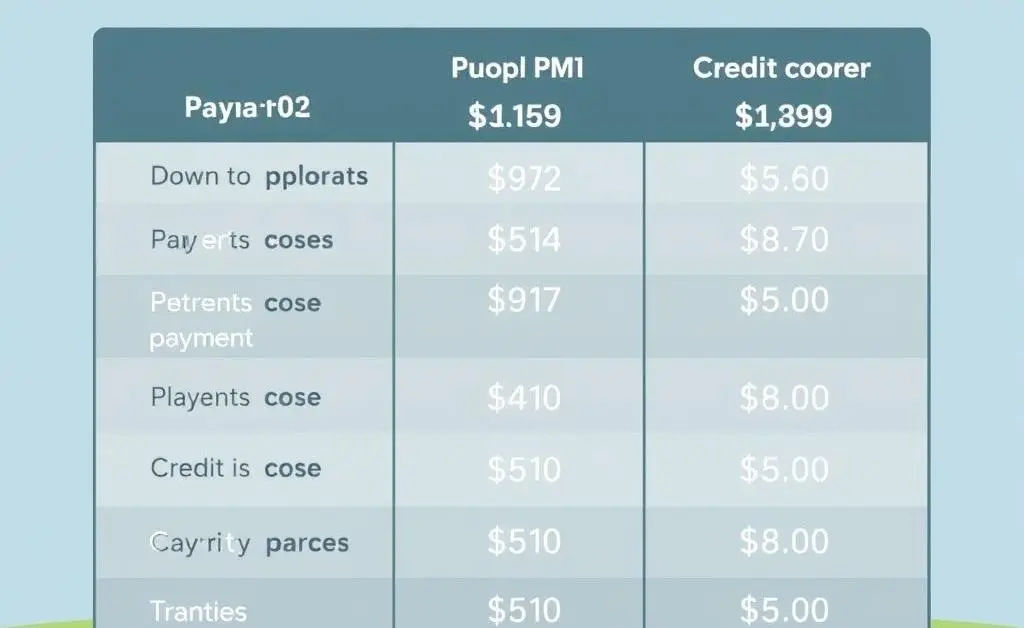

Here's a quick glance at PMI:

- Cost: Typically ranges between 0.3% and 1.5% of your original loan amount per year.

- Duration: It lasts until you’ve reached 20% equity in your home.

- Non-tax-deductible: Unlike mortgage interest, PMI isn’t usually deductible.

Navigating Around PMI

You might wonder, "Can I sidestep this PMI thing?" Luckily, there are several strategies to avoid PMI altogether:

1. Save a Larger Down Payment

If possible, wait until you’ve saved the golden 20% down payment. It’s a big chunk, but it means no PMI headaches, and you'll have a smaller mortgage.

2. Opt for a Piggyback Loan

Think of it as a loan-on-loan, where you take out a second, smaller mortgage to cover the down payment difference. It’s a bit more complex but can work in your favor.

3. Look for Lender-Paid PMI

In some cases, your lender might cover the PMI cost but beware, it often means a slightly higher interest rate.

Conclusion: Is PMI Ever Your Friend?

Though PMI is often seen as a necessary evil, it doesn’t have to be feared. By understanding your options and planning ahead, you can minimize PMI’s impact on your budget. Have you found creative ways to manage or avoid PMI when buying a home? Share your secret sauce in the comments!