Mastering Tax Efficiency: A Path to Financial Independence

Boost your income with smart tax strategies tailored for high earners.

Hey there! Let’s chat about something close to everyone’s mind when earning a high income—tax efficiency. In our quest for financial independence, making your earnings work smarter and not harder is key. Our primary focus today? Boosting your income through smart tax strategies.

Understanding the Importance of Tax Efficiency

Here’s the deal: the higher your income, the more potential for those dreaded taxes to nibble away at your hard-earned money. So, what’s the game plan? We’re going to dive into tax efficiency, a critical component for those targeting financial independence.

Exploring Tax-Advantaged Accounts

One of the simplest ways to manage your tax burden is by maximizing contributions to tax-advantaged accounts such as 401(k)s or IRAs. Think of these as your little secret weapon. Not only do these accounts lower your taxable income, but they also build up retirement savings.

- 401(k) Plans: These allow tax-deferred contributions, which could grow over time without those pesky taxes until withdrawal.

- IRAs: Similar to 401(k)s, they offer tax advantages whether it’s traditional or Roth IRAs were talking about.

Utilizing Health Savings Accounts (HSAs)

Another unsung hero in the world of tax efficiency is the Health Savings Account. If you're like me and enjoy a good health plan, HSAs can be a nifty tool! They offer a triple tax advantage—contributions, earnings, and qualified withdrawals are tax-free.

Strategizing Tax Credits and Deductions

Tax credits and deductions are essentially the Robin Hood of taxes—they bring the rewards back to you. Think credits for education savings, energy-efficient home improvements, or even adoption expenses.

To give you a quick idea:

- Education Credits: Programs like the American Opportunity Tax Credit can save you up to $2,500 annually per student.

- Energy Efficiency: Don’t underestimate the power of going green. Leveraging these credits could offset some hefty costs while saving the planet!

Investing in Yourself and the Future

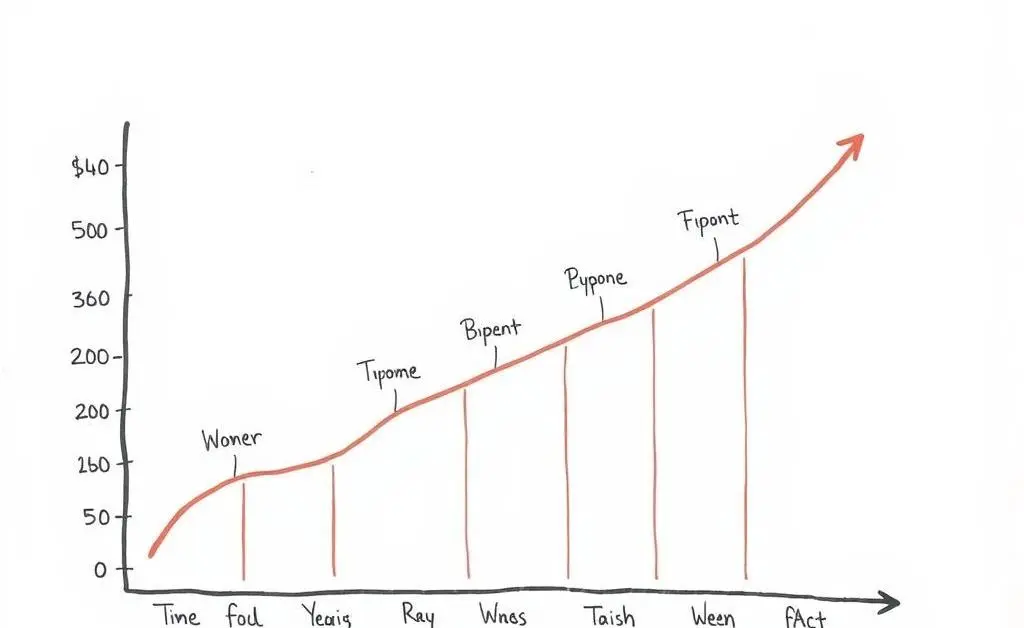

Of course, being smart about your investments is paramount. Diversified portfolios and understanding capital gains can vastly improve tax adequacy. I like to think of it as building a safety net—one that thrives on your savvy decisions.

Wrapping It Up

It’s clear, being that financial-savvy, tax-efficient individual is entirely possible with some knowledge and a good plan. Could there be challenges and hurdles? Sure! But aren’t these just steps towards an ideal financial independence scenario? So, what’ll it be? Are you ready to take charge of your financial future with these tax efficiency tips?

Feel free to share your experiences or questions—I'm all ears!