Mastering the Art of Budgeting: Simple Strategies for Financial Balance

Discover easy budgeting strategies to gain financial balance and peace of mind.

Let's kick off our conversation about budgeting with a simple truth: managing your finances doesn't have to be a chore. Instead, it's a gateway to financial freedom and peace of mind. Trust me, once you get the hang of it, you'll wonder why you ever felt stressed about money in the first place!

Why Budgeting is Essential

Think of budgeting as the art of telling your money where to go instead of wondering where it went. It provides structure, reduces financial anxiety, and most importantly, enables you to prioritize what's truly important to you. Whether that's a dream vacation, a new home, or a robust emergency fund, having a budget helps make these goals achievable.

Getting Started: The Basics

So, where do you start? Begin with the essentials. First, list all of your sources of income. Then, jot down every regular expense – rent, utilities, groceries, and so forth. Creating a comprehensive list may take time, but you'll thank yourself for it later.

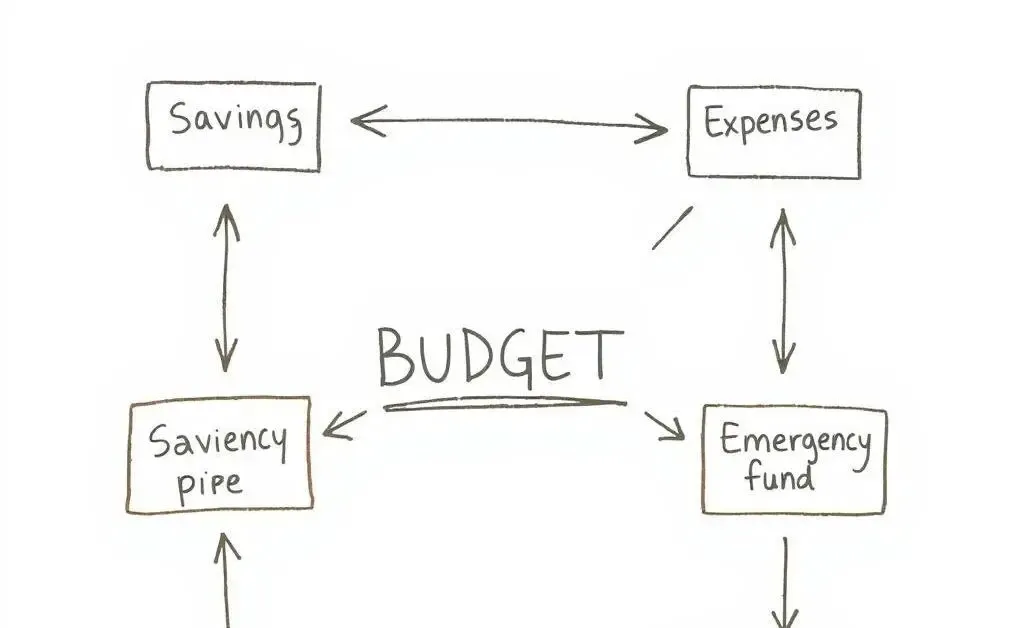

The 50/30/20 Rule

If traditional budgeting feels restrictive, you might want to try the 50/30/20 rule. It's simple: allocate 50% of your income to necessities, 30% to wants, and 20% to savings or debt repayment. This method allows flexibility while ensuring you’re still on track.

Keeping it Real: Flexibility is Key

Life is unpredictable, and so should be your budget. Don’t beat yourself up if you overspend one month. Use it as a learning moment to adjust next month's plan. The key to successful budgeting is consistency, not perfection.

Tools and Tips

To streamline the budgeting process, consider using tools and apps. Many of them connect directly to your bank account, providing real-time insights and alerts to keep you on track. Personally, I've found these to be game-changers.

Conclusion: Embrace Your Financial Journey

In the end, the goal of budgeting isn't to impose restrictions on yourself but to offer freedom and flexibility to pursue what matters most to you. Remember, financial planning is a journey, not a destination. What’s the first step you’ll take towards budgeting bliss?