Mastering the Art of Building a Balanced Investment Portfolio

Learn practical tips to create a balanced portfolio for your financial future.

Ever found yourself staring at your investment account, attempting to make sense of all the numbers and see if your portfolio is really a good one? I’ve been there, and the good news is, by focusing on a few key principles, you can build a portfolio that works like a well-oiled machine.

Why Balance is Key in Your Portfolio

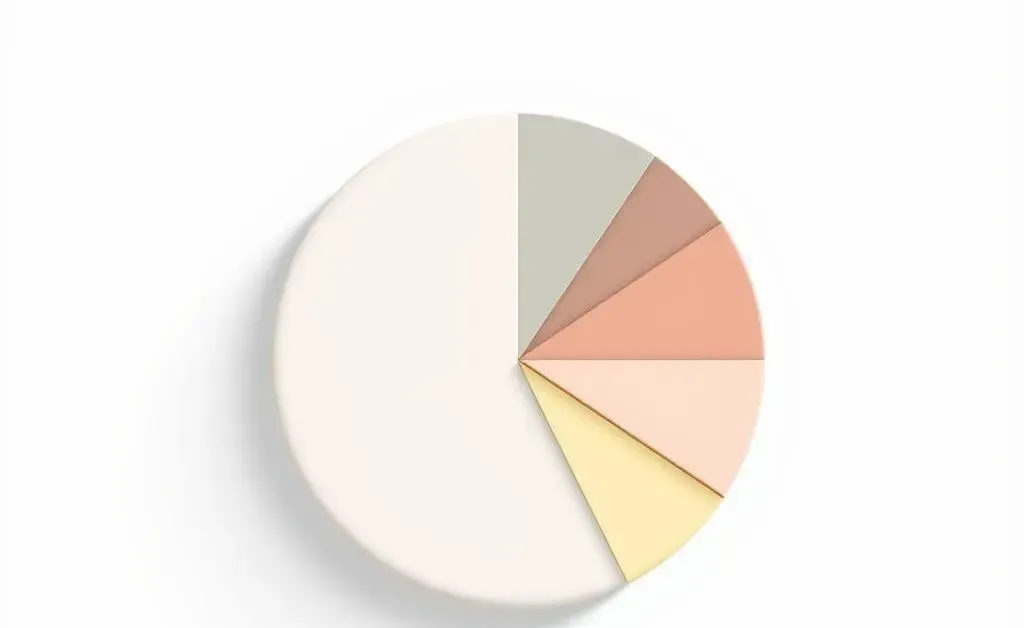

Think of your portfolio like a recipe—you wouldn’t want to bake a cake with just flour. You need sugar, eggs, and a few other essentials to make it tasty. Similarly, a balanced portfolio mixes various asset classes like stocks, bonds, and other securities.

The Foundation: Stocks, Bonds, and Beyond

Stocks and bonds are the bread and butter of most investment portfolios. Stocks give your portfolio the potential to grow significantly, while bonds can offer stability and income.

Aside from these, consider sprinkling in some index funds or ETFs. They often replicate indices, giving you broad market exposure with a single investment.

Asset Allocation: The Secret Sauce

The way you mix these components can majorly sway your risk and return. Think ofasset allocation as the secret sauce; finding your perfect mix might take some tweaking.

For beginners, a common way to determine how much to allocate to stocks is the "100 minus your age" rule. If you're 30, you might consider holding 70% in stocks.

Review and Revise: An Ongoing Journey

Your portfolio isn’t a “set it and forget it” kind of deal. Keep track of your investments and regularly rebalance to align with your goals. Economic conditions change, and so does your life.

In Conclusion: Start Small, Think Big

Building a balanced portfolio doesn't have to be daunting, even if it feels like venturing into a maze of financial jargon. Start small, learn as you go, and your future self will thank you.

Have you started tailoring your own portfolio? What steps do you find most challenging or rewarding? Share in the comments!

If you're ready to dive deeper into portfolio management and financial strategies, there's no shortage of resources to explore. But remember, patience and persistence pay off in the long run.