Mastering the Art of Household Budgeting: Balance, Save, and Thrive

Discover practical tips to create a household budget that works for you and your family.

Let's face it: budgeting isn't always easy. It's like trying to crack a secret code that promises us more financial freedom in exchange for a little discipline and planning. But when done right, it can feel like you've got a map leading to a treasure chest, revealing opportunities to build up savings and spend on things you love without guilt.

Why Budgeting Matters More Than Ever

In today's fast-paced world, it's so easy to lose track of where our money is going. Between quick stops at the coffee shop and spontaneous online shopping sprees, those expenses add up quicker than one might think! The beauty of having a budget is that it provides clarity, helping us make informed choices on spending and saving.

How to Create a Balanced Household Budget

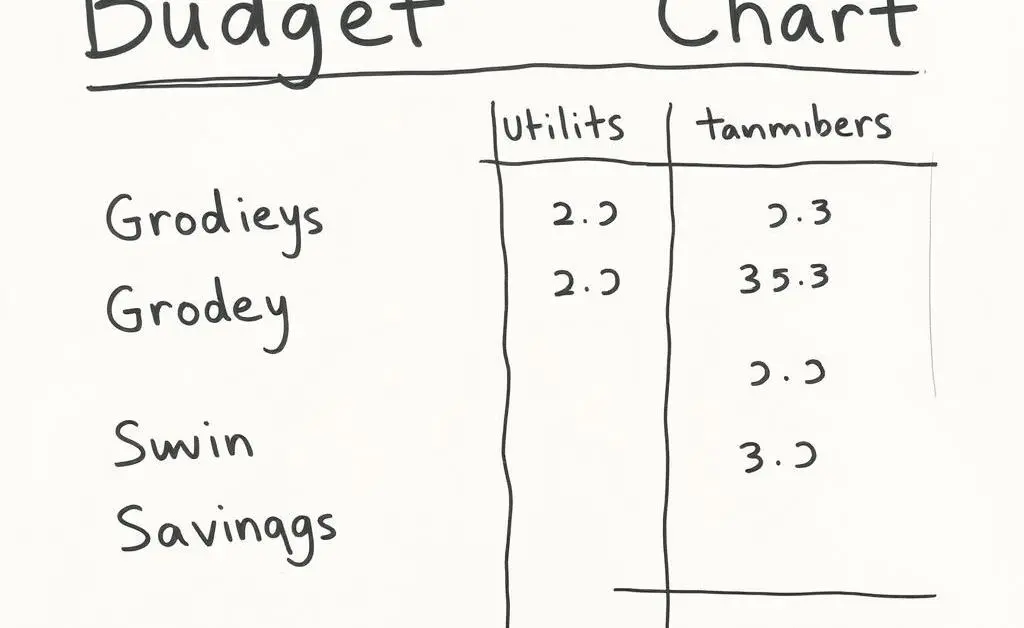

Building a household budget might seem daunting, but breaking it down step-by-step can simplify the process. Start with listing all your income sources and then move to tracking your expenses. Divide them into categories like groceries, utilities, transportation, savings, and yes, even fun money!

1. Track Every Penny

The first step to fine-tuning your budget is knowing exactly where your money goes. Use tools or apps that link to your bank account, automatically categorizing your expenses. Or, go old school with a simple notebook. No matter the method, consistency is key!

2. Don’t Forget the Fun

All work and no play make life pretty dull, doesn't it? A successful budget includes room for occasional indulgences. Just be intentional about them — this means you can still enjoy that fancy dinner out without jeopardizing your financial goals.

Saving Made Easy: Small Tweaks, Big Impact

Sometimes, minor lifestyle adjustments can significantly impact our savings accounts. Consider these small changes:

- Make coffee at home instead of buying it daily.

- Plan meals ahead for the week to avoid unnecessary takeout expenses.

- Set up an automatic transfer to a savings account each payday, even if it's a small amount at first.

These seemingly tiny changes can accumulate larger funds over time, making it easier to handle emergencies or splurge on a well-deserved holiday.

Conclusion: Embrace the Budget Lifestyle

Budgeting doesn't mean cutting all the joy out of life. It's about optimizing your financial resources so each dollar aligns with what matters most to you. Over time, as your savings grow and your spending habits become more focused, you'll thank your past self for taking these steps.

Have you found any unique budgeting hacks that work wonders for you? Feel free to share your tips!