Mastering Your Investment Portfolio: Practical Tips for the Curious Investor

Explore practical tips for creating a balanced investment portfolio you'll love.

If you're like me, the thought of crafting an investment portfolio can feel both exhilarating and daunting. It's like assembling the ultimate dream team, but instead of players on a field, you're dealing with stocks, bonds, and maybe even a sprinkle of cryptocurrency. If you've ever pondered how to build an investment portfolio that suits your life goals, you're in the right place.

What is an Investment Portfolio?

An investment portfolio is a collection of assets like stocks, bonds, commodities, and other financial instruments. Imagine it as your personal toolkit for wealth building. The right mix can help hedge against risks and maximize potential gains.

Why Diversification Matters

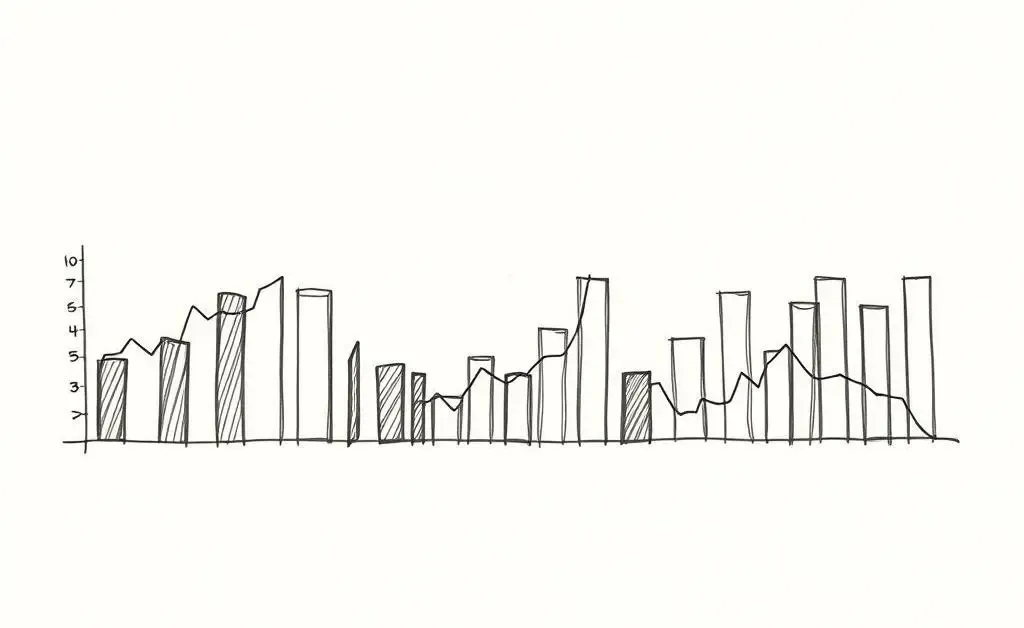

Diversification is investing’s gold standard—it’s what keeps your portfolio balanced even when the market takes unpredictable turns. By spreading your investments across different asset classes, sectors, and geographies, you reduce risk and ensure that not all your eggs are in one basket.

According to experts, including a diverse range of assets in your portfolio can protect against the volatility of the market. So even if one section of your portfolio isn’t doing so well, others might be performing better to balance the overall performance.

How to Assess Your Risk Tolerance

You may have heard the term 'risk tolerance' floating around. It's basically your ability and willingness to weather financial storms without losing sleep. Ask yourself some honest questions: How comfortable are you with the ups and downs of the stock market? Would you panic if you saw a double-digit drop in one of your asset’s value?

Understanding your risk tolerance helps shape the composition of your portfolio. For instance, if you're risk-averse, you might prefer bonds over volatile stocks.

Conclusion: Building Your Dream Portfolio

Creating a great investment portfolio isn’t just about picking the right stocks or bonds; it’s about personalizing it to suit your lifestyle and financial aspirations. It doesn’t hurt to regularly check up on it, rebalancing your investments annually to ensure everything aligns with your risk tolerance and goals.

So, whether you're new to investing or looking to fine-tune your approach, remember that an investment portfolio is a reflection of you—constantly evolving and growing. Got thoughts or questions on building your portfolio? Feel free to dive into the comments and let’s chat!