Mastering Your Investment Strategy: Insights for the Curious Investor

Discover practical investment insights and strategies for curious investors.

Investing: Where Do You Begin?

Have you ever caught yourself daydreaming about your financial future, only to feel slightly overwhelmed by investment choices? You're not alone. Let's unpack some key insights to help you navigate the intricate world of investing with confidence and ease.

Understanding the Basics

Before diving headfirst into investments, it's crucial to grasp some fundamental concepts. Imagine them as the building blocks for a solid financial house. Here are a few to keep at the front of your mind:

- Risk Tolerance: Understanding how much uncertainty you can handle with your investments.

- Diversification: Don't put all your eggs in one basket.

- Long-Term Goals: Where do you see your portfolio in 10 or 20 years?

A Journey of Continuous Learning

Investing isn't a one-time process—it’s a journey. Remember the first time you tried cooking a new recipe? There was a learning curve, right? Investing is much the same, where you continually learn and adapt. Start small, absorb knowledge, and evolve.

Personal Anecdote: The Start of My Investment Story

Allow me to share a snippet of my journey. I remember the first time I tried my hand at investing. I felt like a small fish in a vast ocean. With some guidance, persistence, and a bit of humor, I've managed to build a foundation that feels less like navigating stormy waters and more like setting sail on a calm sea.

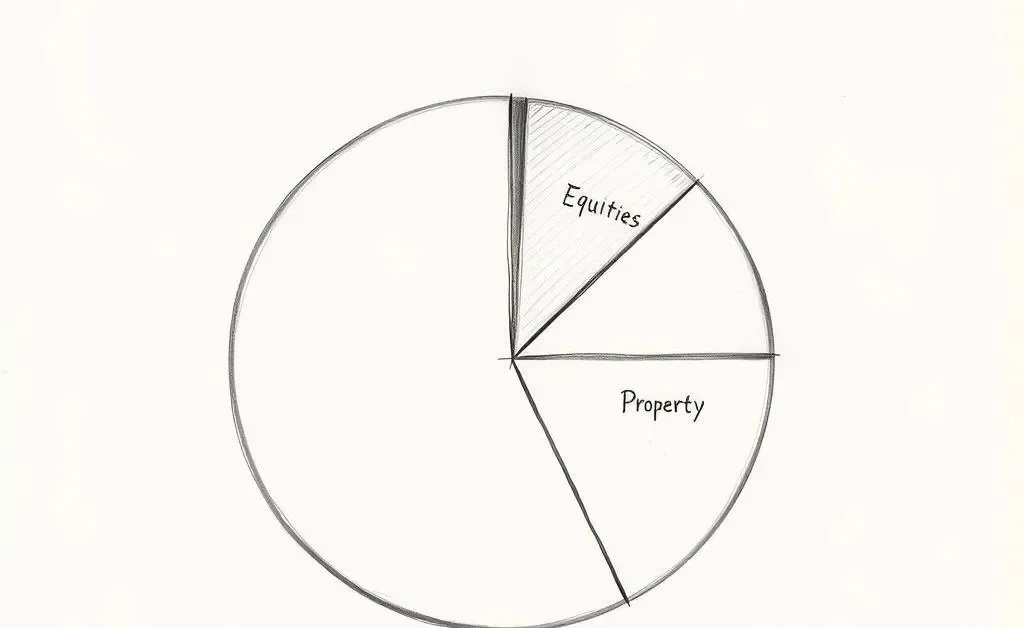

Balancing Act: Risk and Reward

Balancing risk and reward is an art, and it's central to your investment journey. It helps to think of your portfolio as a mix of contrasting elements that together form a beautiful, cohesive whole. Here's how:

- Stock Investments: Often high-risk, high-reward.

- Bonds: Typically provide stability and predictable returns.

- Real Estate: Offers tangible value and a different kind of risk-return profile.

- Mutual Funds: A way to diversify across various assets.

Wrapping Up

You're not just an investor; you're crafting your financial future piece by piece. As you weave this tapestry of investments, do it with curiosity, patience, and a touch of creativity. What investment strategy are you most curious to explore next?