Maximize Rewards: The Essential Guide to Smart Credit Card Churning

Discover smart strategies for maximizing credit card rewards without compromising your credit score.

Have you ever heard of people flying first class or enjoying luxury accommodations for little to no cost and wondered how they do it? The secret is savvy credit card churning. It’s like a financial game of chess, where the goal is to maximize rewards without compromising your credit score. Let’s dive into the world of credit card rewards and how you can benefit from them!

Understanding the Basics of Credit Card Churning

Credit card churning is the practice of signing up for credit cards to earn sign-up bonuses and rewards points, then moving on to the next card. Sounds simple, right? But there’s a strategic art to it. Let me tell you a story about my friend Jake, who mastered this art. He went from racking up fees to sipping cocktails on a beach entirely paid for by reward points. His secret? Discipline and understanding the fine print.

Key Tips for Effective Credit Card Churning

- Research Thoroughly: Compare different credit cards for their bonus offers and ongoing rewards.

- Plan Your Spending: Make sure you can meet the minimum spend requirements to earn bonuses.

- Track Your Applications: Keep a record of your application dates and card terms.

- Monitor Your Credit Score: Regularly check your credit history to avoid declines.

- Cancel Carefully: Be strategic about closing accounts, as this can affect your credit.

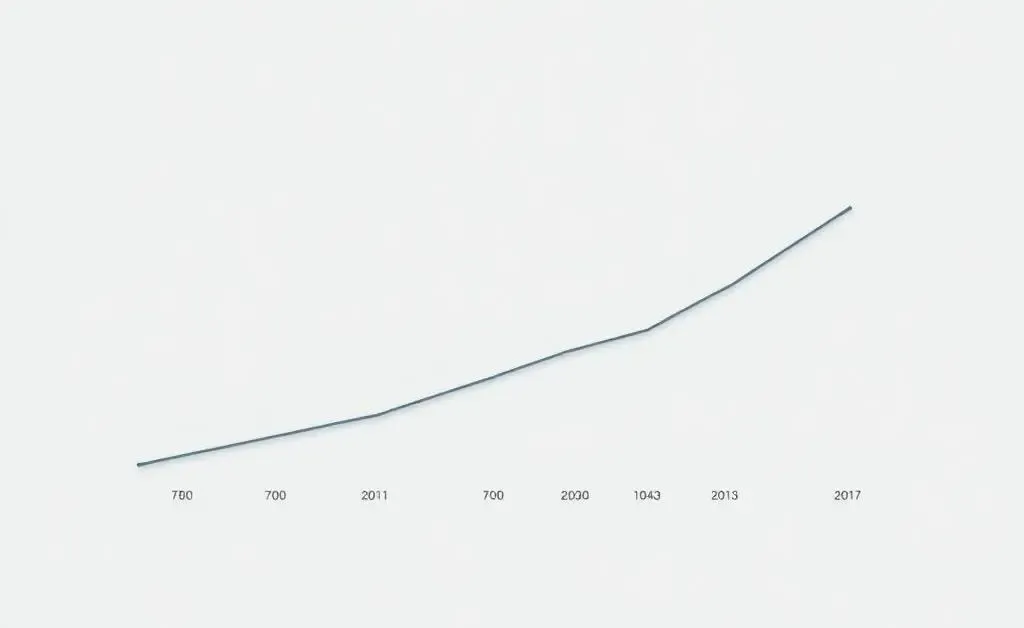

Can Credit Card Churning Hurt Your Credit Score?

One common concern is credit impact. While opening and closing accounts does affect your credit score, Jake found it didn't ruin his credit. In fact, by keeping a low credit utilization rate and paying off balances monthly, his score improved. Think of it this way: credit health is a marathon, not a sprint. This can be an opportunity to enhance your credit knowledge and responsibility.

Making the Most of Your Rewards

Here’s where the fun begins! Once you've learned the ropes, the rewards start stacking up. Travel points are the most popular, but don’t forget about cashback and gift cards. These rewards can cover everything from your morning coffee to a weekend getaway.

Conclusion: Is Credit Card Churning Right for You?

If used wisely, credit card churning can be a powerful tool in your financial arsenal. It's like a treasure hunt with tangible prizes. Just remember to stay organized, keep an eye on your credit, and don’t forget to enjoy the rewards. What’s the first thing you'd redeem your points for?