Maximize Your Credit Card Benefits: A Beginner's Guide to Churning

Discover how to navigate credit card churning efficiently and safely.

Have you ever heard of credit card churning? It's not about blending credit cards into smoothies, I promise. Credit card churning involves signing up for credit cards to snag hefty sign-up bonuses, rack up rewards, and maximize travel points. Sounds lucrative, right? But, beware! Without a plan, it's easy to slip into debt. Let's dive into the ins and outs and learn how to churn like a pro.

What is Credit Card Churning?

In simple terms, credit card churning is the practice of opening up new credit cards to take advantage of sign-up bonuses and promotional offers. The key here is management. The goal is to reap the rewards without getting tangled in interest rates or hefty debts. Check out current top sign-up bonuses here.

Benefits of Churning

- Sign-Up Bonuses: Many cards offer enticing bonus points after meeting specific spending requirements within a set period.

- Travel Rewards: Accumulate points fast for airline tickets, hotel stays, or other travel perks.

- Cash Back: Some cards provide direct cash earnings for every dollar spent.

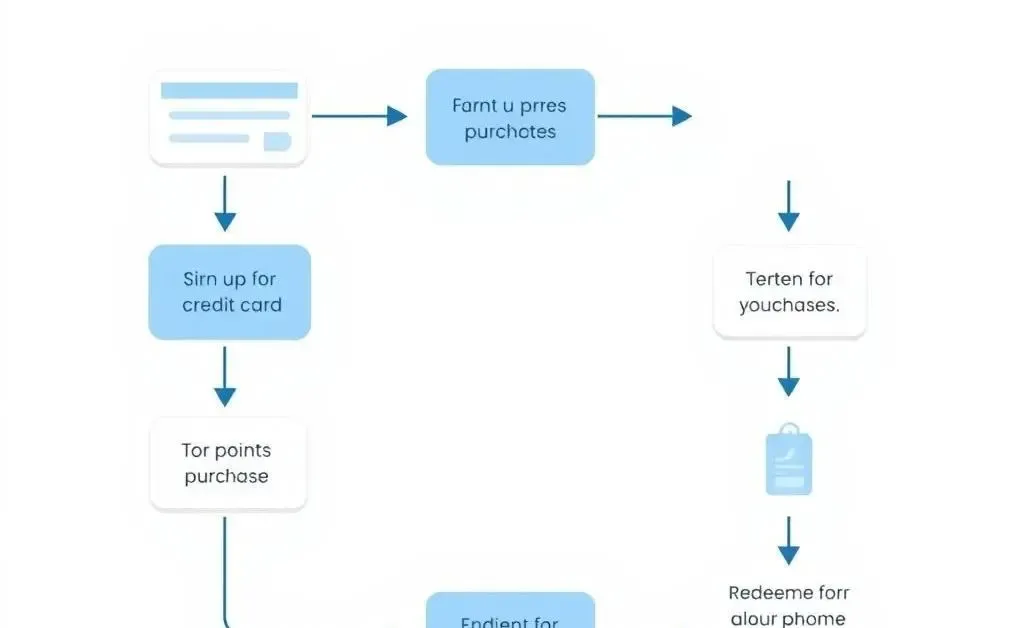

How to Start Credit Card Churning

It's all about strategy:

- Research Cards: Identify cards with valuable rewards that align with your expenses.

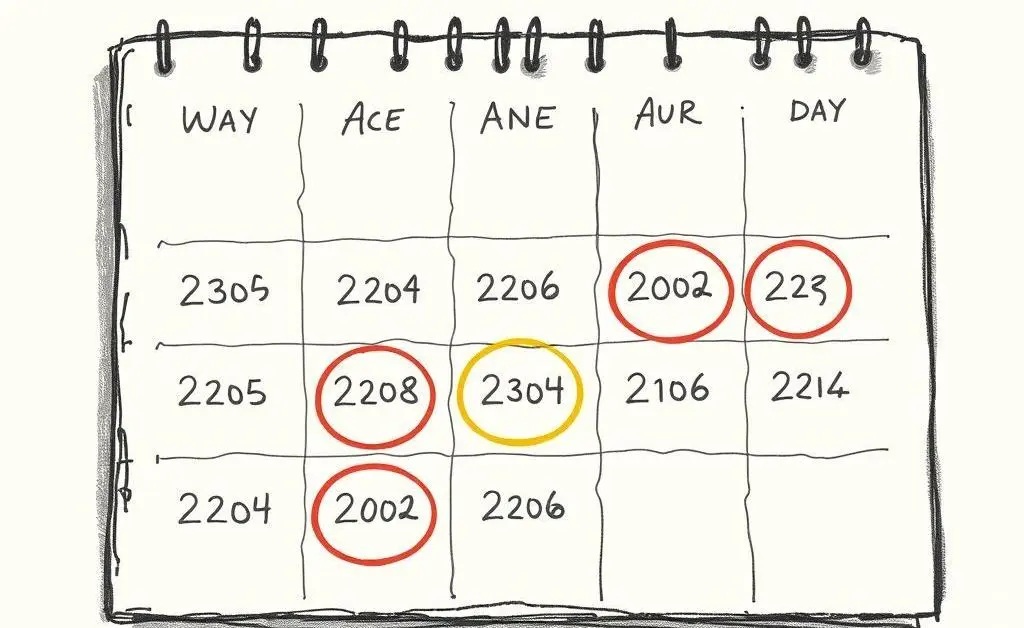

- Understand Requirements: Be acquainted with spend thresholds and due dates to access rewards without accruing fees.

- Track Expenses: Maintain a log to ensure you maintain spending within your means.

Potential Pitfalls

While the lure of bonuses can be exciting, here are a few cautions:

- Credit Score Impact: New applications can initially dip your score. Too many rapid openings can be risky.

- Debt Danger: It’s easy to overspend when aiming for bonus thresholds.

- Annual Fees: Ensure the rewards outweigh any potential fees associated with the cards.

Reward Redemption Strategies

Don’t just let those hard-earned points sit around!

- Redeem Wisely: Aim for the best value by using points on travel or through exclusive portals offered by your card.

- Stay Informed: Regularly check for offers and changes in point value or redemption options.

So, is credit card churning for you? Maybe! If you meticulously manage finances, stay clear of debt, and savor strategizing, it could be a rewarding hobby with tangible perks. What's your take on credit card churning? Have you dabbled, or is it on your radar for future financial fun?