Maximizing Credit Card Rewards: A Friendly Guide to Smart Spending

Learn to navigate credit card rewards with these practical tips for maximizing benefits and avoiding pitfalls.

Ever wondered how some folks seem to jet off to tropical getaways or opt for first-class upgrades without batting an eyelid? The secret often lies in smart credit card usage. You might be surprised by how rewarding everyday spending can be if you know the ropes.

Why Credit Card Rewards Matter

Using credit cards wisely can be akin to finding a hidden stash of gold. They offer a way to earn while you spend, providing incentives like travel miles, cashback, or even gift cards. The trick is diving into the world of rewards with clear goals and a strategy.

Choosing the Right Cards

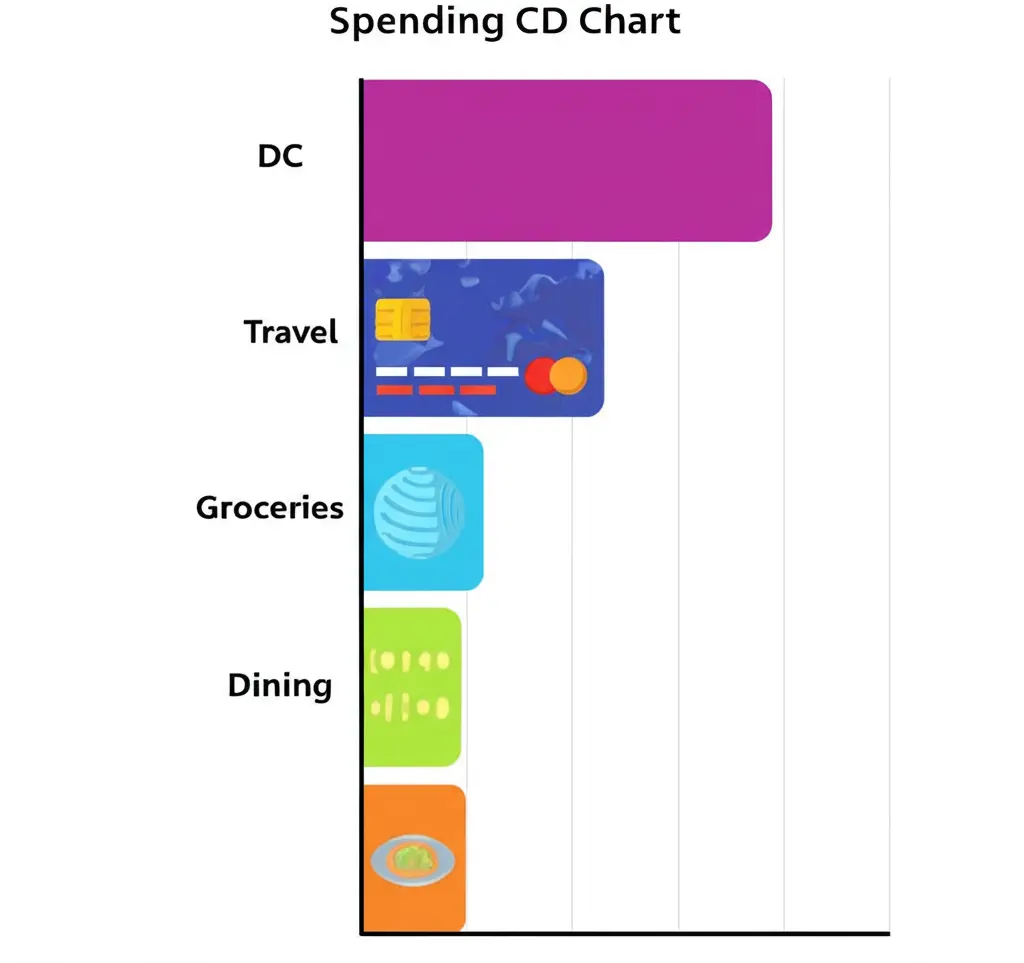

The cardinal rule? Always align your credit card with your spending habits. If you're a frequent flyer, a card with travel perks can be gold. On the other hand, if dining out is your thing, look for cards offering high rewards in that category. Some offer general cashback, making them versatile sidekicks in your wallet.

Avoiding Common Pitfalls

Now, let's flip the coin. Having multiple cards can be tempting, but it doesn’t mean you should max them out. A common mistake is not keeping track of due dates, leading to interest charges that overshadow any reward benefits.

Moreover, it’s crucial to read the fine print. Sometimes, the allure of bonus points can blind you to annual fees or other hidden costs. Staying informed ensures that rewards don’t become more costly than they’re worth.

Maximizing Rewards

On a brighter note, think about how you can consolidate spending to stack up points. Many cards offer additional bonuses if you hit certain spending thresholds. Setting monthly spending targets can end in a jackpot of rewards!

Conclusion

So, are credit card rewards worth the effort? Absolutely, but with nuanced care and attention. Think of your cards as tools—handled smartly, they can unlock experiences or save a tidy sum. What’s your secret hack for maximizing rewards? Share below, and let’s get the conversation going!