Maximizing Credit Card Rewards: How to Use Uncapped Cashback Offers Wisely

Discover how to make the most of uncapped credit card cashback offers with smart tips and tricks.

Have you ever found yourself pondering how to make the most of your credit card rewards? Uncapped cashback offers can seem like a gold mine, but knowing how to use them wisely is key. In this post, let's explore how to optimize these opportunities for maximum benefit.

What Are Uncapped Cashback Offers?

Uncapped cashback offers are promotions where your cashback rewards are not limited by a maximum dollar amount. This means the more you spend, the more rewards you can earn — sounds enticing, right?

Why These Offers Can Be Beneficial

Unlike capped programs where you hit a ceiling, uncapped offers allow for continuous earnings. By understanding your spending habits and aligning them with these rewards, you have the potential to earn substantial back on purchases you were already planning to make.

How to Approach Uncapped Cashback Offers

Let me tell you a story about my friend, Jess. She's a savvy shopper who never misses out on a good deal. When she recognized the potential of uncapped cashback, she started tracking her expenses using a budgeting app. Here's what Jess did to make the most of her credit card rewards:

- Frequent Purchases: Jess focused on using her card for everyday purchases like groceries and petrol, maximizing consistent spending.

- Monthly Check-ins: She set reminders to check her statements, ensuring she never left cashback unclaimed.

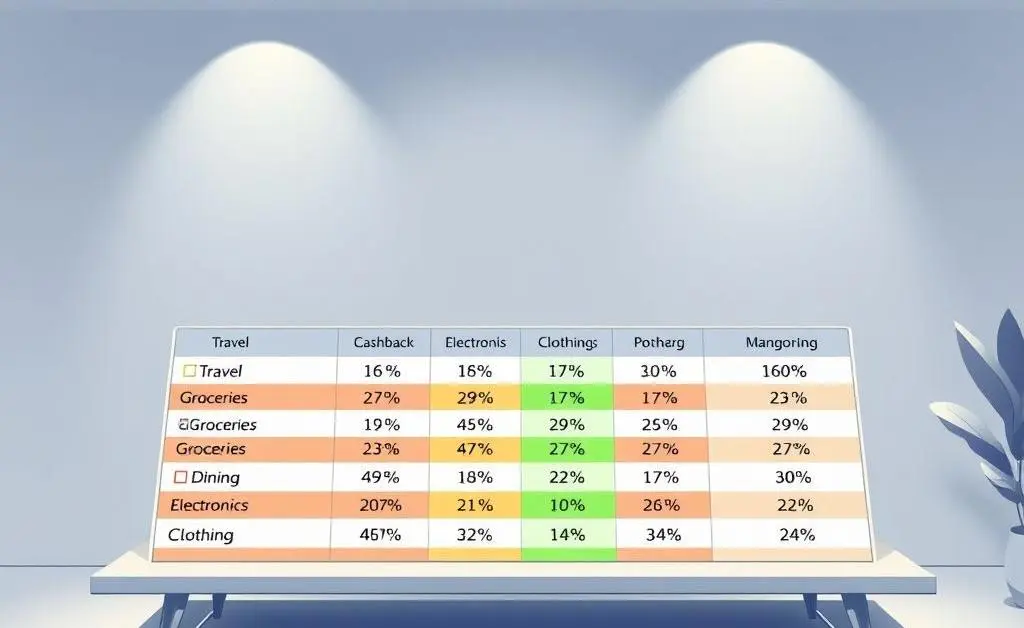

- Strategic Spending: Jess adjusted buying habits to match the categories with the highest cashback percentages.

Cautions to Keep in Mind

Balanced spending is essential. Even though it’s tempting to chase cashback rewards, it’s crucial to maintain a budget and avoid unnecessary debt. Leveraging these offers works best when you're spending within your means.

Final Thoughts

Uncapped cashback offers can be a delightful aspect of responsible credit card use, rewarding you for money you would have spent anyway. By planning strategically, tracking your spending, and choosing the right offer, you can maximize your rewards.

How do you plan to utilize your credit card rewards this month? Share your thoughts, and let's keep the conversation going!