Maximizing Your Profit with Credit Card Rewards: Simple Steps

Learn effective strategies to get the most from your credit card rewards in simple, practical steps.

Hey there, fellow credit card enthusiast! Have you ever wondered how some people seem to fly for free or nab those sweet gift cards without breaking a sweat? I'm here to share some tips and insights on how to maximize your credit card rewards without turning your life upside down.

Whether you're a seasoned pro or just dipping your toes into the world of rewards, there's always room to optimize your strategy. So, let's dive right in!

Understanding the Basics of Credit Card Rewards

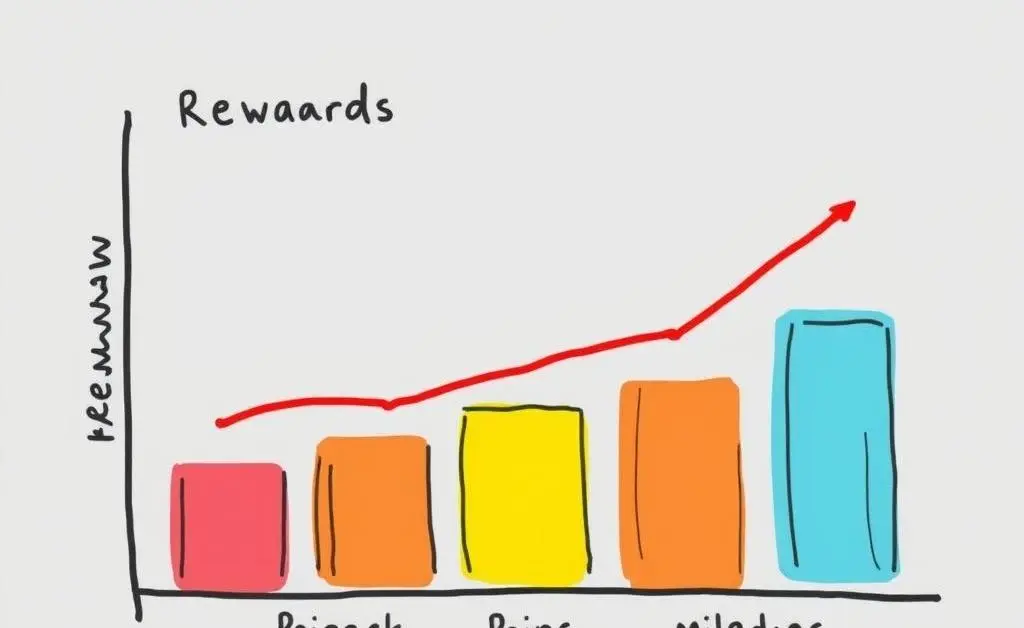

First things first, let's get on the same page. Credit card rewards typically come in three flavors: cashback, points, and miles. Each has its unique benefits, and choosing the right one depends on your spending habits.

- Cashback - Best for those who want simple, direct savings.

- Points - Ideal if you enjoy redeeming for a variety of products or services.

- Miles - Perfect for frequent travelers looking to save on flights and lodging.

Picking the Right Card

Before you can maximize rewards, you need the right toolkit—your credit cards! Aim to have cards that align with your spending habits. If you love dining out, find a card that offers greater rewards at restaurants. Enjoy online shopping? Look for cards with bonus rewards for e-commerce.

Strategies to Maximize Your Rewards

Take Advantage of Sign-Up Bonuses

Sign-up bonuses are like the golden ticket of credit card rewards. These offers typically require you to spend a certain amount within a few months. Plan your big purchases around these periods to hit the required spending without going overboard.

Stay Informed About Rotating Categories

Some cards offer quarterly rotating categories with extra rewards. Mark your calendar and plan your spending to match these categories, like using a specific card more frequently when groceries or travel offer higher cashback.

Monitoring and Managing Your Rewards

Part of extracting the most value from your rewards involves keeping track of them effectively. Consider using apps or spreadsheets to monitor your points and redemption options. This way, you won't miss out on any expiring benefits.

Evaluate Redemption Value

Not all rewards are created equal. Often, redeeming points for travel or transferring them to airline partners can yield more value than simply using them for a gift card or cashback option. Do the math and choose the best option!

Conclusion: Keep It Fun!

Maximizing credit card rewards can be a fun and profitable hobby when done responsibly. Just remember not to overspend just for points and always pay your balance in full to avoid interest charges.

How do you make the most out of your rewards? I'd love to hear your strategies!