Navigating 401(k) Changes: Should You Rethink Your Contributions?

Confused about adjusting your 401(k) contributions? Get insights and strategies in under 5 minutes.

Hey there! If you're staring at your 401(k) statement and wondering if it's time to tweak those contributions, you're not alone. With recent changes swirling in the world of retirement plans, it's a smart moment to press pause and consider your options.

Understanding 401(k) Changes

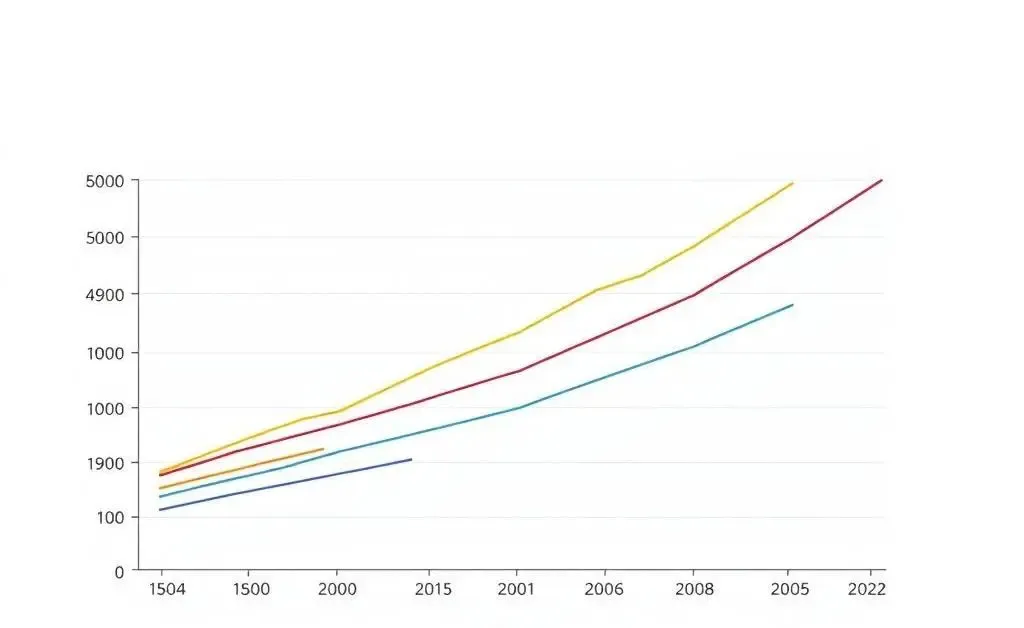

The landscape of 401(k) plans is evolving, and staying informed is more crucial than ever. Recent regulatory updates and economic shifts might affect how much you're setting aside for your golden years. Are you up to date?

With these changes, you might be asking yourself: should you reduce, maintain, or even increase your contributions? That's the million-dollar question or perhaps even the retirement-dollar question.

Factors to Consider

Your Current Financial Picture

Take a moment to evaluate your finances. Do you have debts to clear, or other savings goals lined up? Remember, balancing short-term needs with long-term gains is key.

Retirement Goals

Where do you see yourself decades from now? Let that vision guide your decisions today. Calculate if your current 401(k) approach aligns well with that dream.

Pros and Cons: To Adjust or Not?

| Pros of Reducing Contributions | Cons |

|---|---|

| Freed-up cash for immediate needs or other investments | Potentially missing out on employer match and compound growth |

| Flexibility for shifting priorities | Reduces funds available at retirement |

Balancing these pros and cons isn't black and white. Consider speaking with a financial advisor who can offer personalized guidance.

Final Thoughts

Adjusting your 401(k) contributions is a strategic move. It’s like tweaking the sails during a voyage; small adjustments now can steer your financial ship in the right direction. Are you ready to make a change, or is your current course just right? Whatever you decide, aim to revisit your plan regularly.

What's your take? Have you thought about your 401(k) lately? Share your thoughts and let’s navigate this journey together!