Navigating Auto Insurance in Michigan: What You Need to Know

Discover key insights and tips about auto insurance in Michigan.

Hey there! Ever wondered why auto insurance in Michigan seems to cost an arm and a leg? You're not alone. Michigan's unique no-fault insurance laws and coverage requirements can puzzle even the savviest car owners. Let's break down the essentials so you can make informed choices when shopping for auto insurance in Michigan.

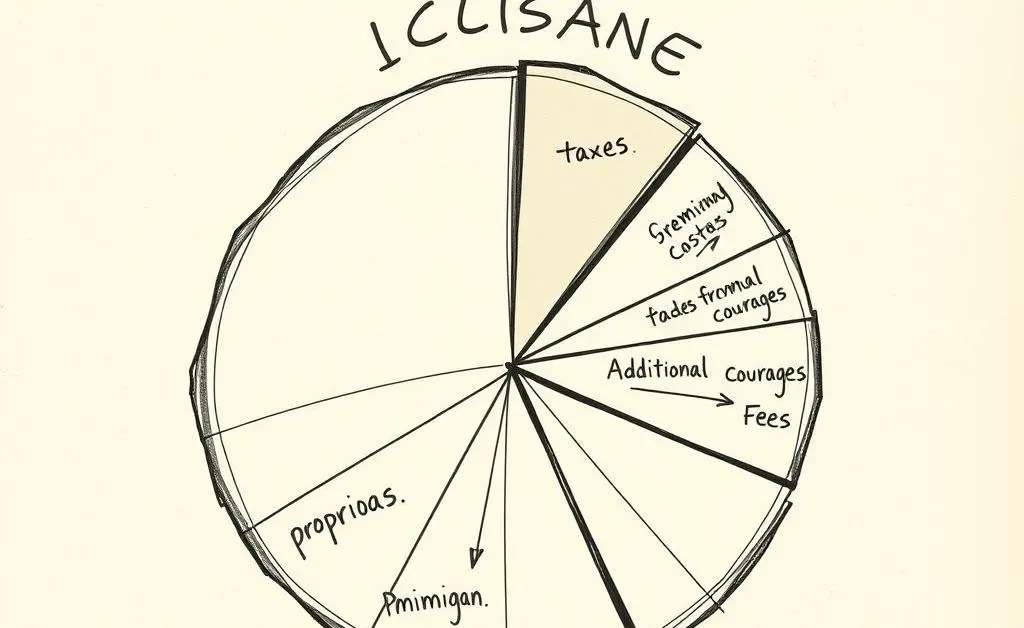

Why is Michigan Auto Insurance So Expensive?

Michigan stands out with its no-fault insurance system, designed to simplify claims and ensure drivers get a quick payout regardless of fault. However, this system comes with a trade-off—higher premiums.

- All drivers must carry Personal Injury Protection (PIP) that covers unlimited lifetime medical benefits for car accident injuries.

- Additionally, Michigan's liability coverage minimums are markedly higher than in most states.

- The no-fault system often leads to increased fraudulent claims, adding to the overall premium costs.

The combination of these factors is why residents often find themselves paying more than in neighboring states.

Tips to Reduce Your Auto Insurance Costs

While Michigan’s insurance system is undoubtedly unique, you can still find ways to manage costs without compromising coverage quality:

1. Shop Around: Don’t settle for the first quote. Each insurance company will calculate risk differently, so comparing policies could save you hundreds.

2. Evaluate PIP Coverage: Michigan now allows you to choose different PIP coverage levels. Consider your medical coverage needs and choose accordingly.

3. Increase Your Deductible: A higher deductible often means lower monthly premiums. Just be sure you can afford the out-of-pocket expense in the event of a claim.

4. Explore Discounts: Many insurers offer discounts for safe driving, bundling policies, or setting up automatic payments.

Anecdote: The Smiths’ Insurance Dance

Meet the Smith family from Grand Rapids. They’d been with the same insurer for a decade, too comfortable to question their rising premiums. But after a coffee chat with a friend who mentioned saving big by switching insurers, they decided to explore their options. The result? The Smiths found a new policy that not only saved them $500 a year but also offered better coverage! A little effort in shopping around proved immensely rewarding.

Looking Forward

The landscape of auto insurance is continually evolving. As you consider your car insurance options in Michigan, stay informed and proactive. You might find an opportunity to lower your costs even if change feels daunting.

What challenges have you faced while navigating your insurance choices, and how did you overcome them? I'd love to hear your stories!