Navigating Bankruptcy: The Real-Life Impact and What to Expect

Discover the real-life impact of bankruptcy and how to navigate it smoothly.

Hey there! Let's chat about something that often feels like an elephant in the room — bankruptcy. It can seem daunting and overwhelming, but there's plenty to understand and demystify when it comes to this financial move.

What Exactly is Bankruptcy?

In simple terms, bankruptcy is a legal status for individuals or companies that cannot repay their outstanding debts. While it might sound terrifying, it's essentially a financial reset button; it allows you to clear significant debts under the protection of a formal process.

Immediate Impact of Declaring Bankruptcy

Taking the step to declare bankruptcy indeed carries immediate consequences. One of the first impacts is the halt of collection activities — no more harassing calls from collectors, which can provide a huge sense of relief. However, it also means you're signing up for a financial restructuring that demands transparency and cooperation.

What Happens to My Assets?

This is a biggie: once you file, a trustee will assess your assets. While the rules vary by jurisdiction, potential loss of assets is something to consider. Essentials like clothing or necessary household items often remain untouched, but significant assets could be liquidated.

How Does Bankruptcy Affect My Credit?

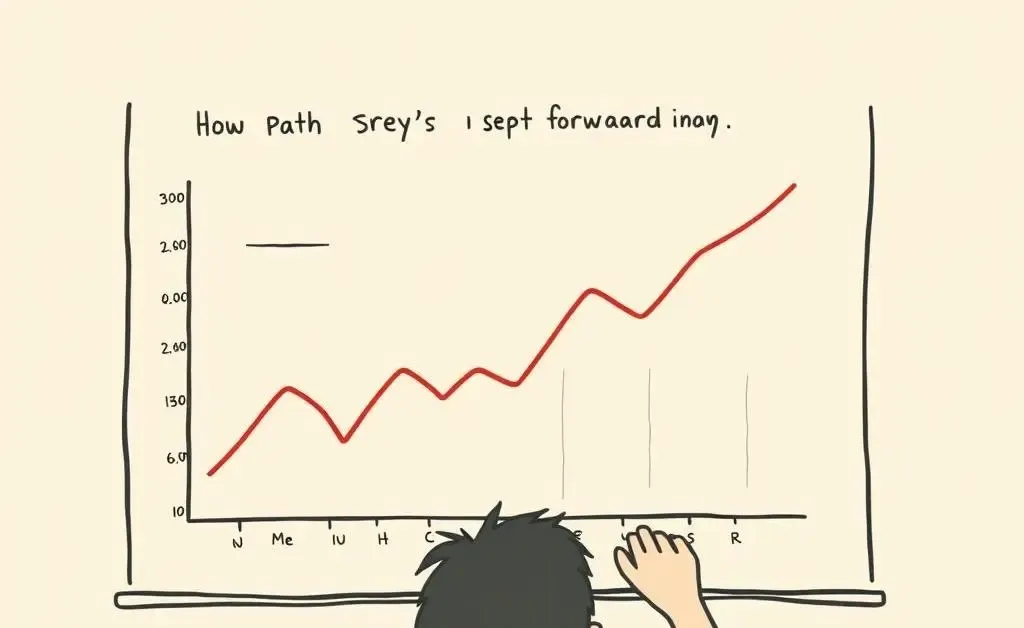

It's no secret that bankruptcy impacts your credit score dramatically. Your ability to borrow will be restricted for a period after your discharge, typically lasting around six years. But here’s a comforting thought: by responsibly managing finances post-bankropy, you can rebuild your score over time.

Life After Bankruptcy

There's light at the end of the tunnel! Post-bankruptcy, crafting a budget and sticking to it is pivotal. Consider opening a secured credit card to begin rebuilding your credit. It’s a journey, but plenty of people have walked this path and emerged more financially resilient.

Is Bankruptcy the Right Choice?

This is a deeply personal decision and weighing the pros and cons with a financial advisor could be incredibly beneficial. Remember, it's not an end but rather a fresh start for you to create a stable financial future.

I'd love to hear from you — have you or someone you know gone through bankruptcy? What were the takeaways? Let's keep this conversation going in the comments below!