Navigating Car Insurance: Insights and Tips for Michigan Residents

Get practical tips on Michigan car insurance and tackle common challenges effortlessly.

Choosing the right car insurance in Michigan can feel like finding your way through a maze, doesn't it? Michigan's no-fault insurance laws are both a blessing and a curse, making coverage seem more complex than a Sudoku puzzle. If you find yourself scratching your head over your policy, you're not alone. In this post, we'll unravel the mysteries of Michigan car insurance and arm you with the insights you need.

Understanding Michigan's No-Fault Insurance

Michigan's unique no-fault insurance system aims to reduce court involvement, covering medical expenses and lost wages regardless of who caused the accident. But what does it really mean for drivers like us?

What You Need to Know About Coverage

- Personal Injury Protection (PIP): This covers your medical expenses. In Michigan, you can choose varying levels of PIP to suit your needs and budget.

- Property Protection Insurance (PPI): Covers damage you might do to another's property while driving — up to $1 million.

- Residual Liability Insurance: Protects you from being sued in certain circumstances outside the no-fault system.

Each of these components plays a role in safeguarding you from financial pitfalls on the road.

Tips to Save on Your Michigan Car Insurance

Insurance can be pricey in Michigan, but there are ways to save without skimping on coverage:

Shop Around and Compare

Remember Jane, our hypothetical friend who spent an entire weekend comparing insurance quotes? She found that rates can vary significantly from one provider to another. Take a leaf out of Jane's book: Compare quotes from at least three different companies.

Look for Discounts

Many insurers offer discounts for good driving records, bundling policies, or even installing anti-theft devices. So, if you've been a defensive driving hero or have multiple policies, make sure you reap those rewards.

Adjust Your Deductibles

Higher deductibles can lower your premium significantly. Just make sure you have enough funds set aside to cover the deductible if you have to file a claim.

Finding the Right Coverage: What Do Folks in Michigan Really Want?

Many drivers desire a balance between cost and coverage, which is easier said than done. Prioritize what matters most to you: peace of mind (maximum coverage) or affordability? Adjusting coverage levels according to your vehicle's value and personal risk comfort can tailor your policy perfectly.

The Importance of Reviews

Before sealing the deal with an insurance company, check customer reviews and ask for recommendations. Websites like Insure.com can provide valuable insights into customer satisfaction levels.

Conclusion: Ready to Hit the Road?

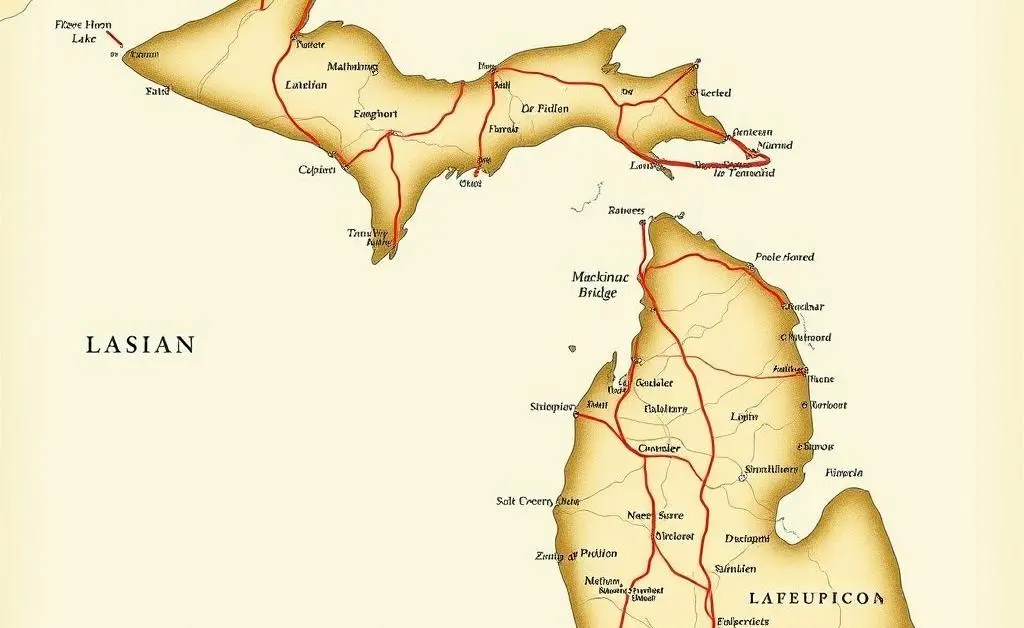

Choosing car insurance in Michigan requires more than just ticking boxes — it's about crafting a safety net that matches your journey's needs. Does your current policy make you feel secured, or is it time for a little comparison shopping? The open road can be unpredictable, but with the right coverage, you can drive through Michigan's beautiful landscapes worry-free. Got any funny or frustrating insurance moments you’d like to share? Let's chat in the comments!