Navigating Car Insurance: What to Do When You’re Not at Fault and Uninsured

Explore options and steps when an uninsured car accident isn't your fault.

Imagine you're on your way to work, cruising along your usual route, and boom! Another car sideswipes you at an intersection. You're flustered, they're apologetic, but here's the catch—you don't have insurance. What do you do when you're not at fault in an accident, yet find yourself without coverage?

First Steps After an Accident

Despite the chaos, taking the right steps immediately after an accident can make a world of difference. Here's a quick checklist:

- Stay calm and assess injuries. Safety comes first!

- Call the police and report the accident. An official report can help clarify fault.

- Exchange information with the other driver, including name, contact, and insurance details.

- Gather evidence like photos, witness contacts, and notes about the incident.

Understanding Your Options

Being uninsured complicates matters, but all hope is not lost. You can still seek compensation if the other driver is at fault:

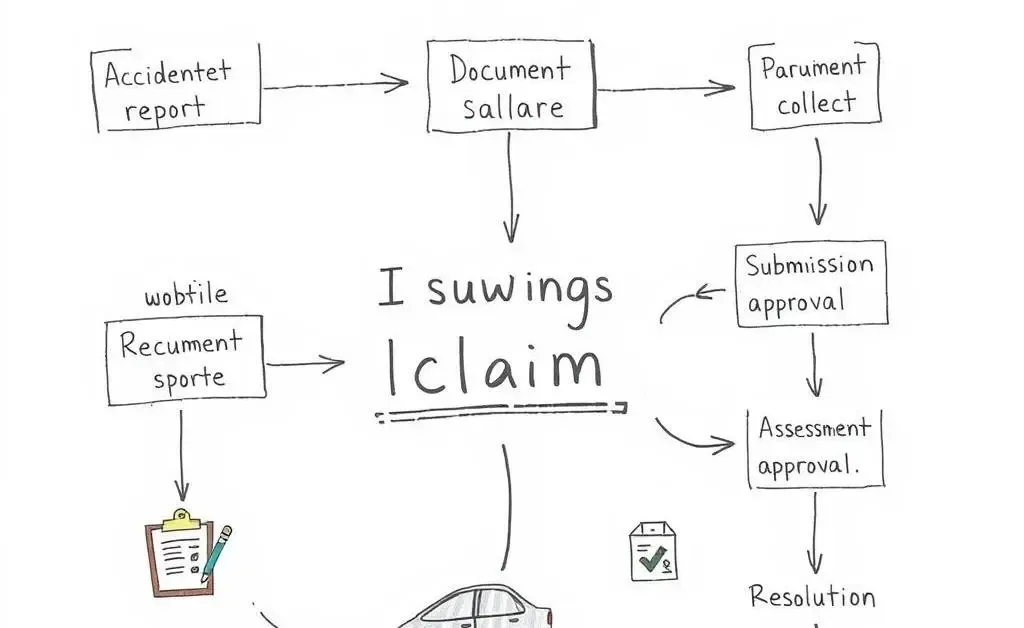

Filing a Third-Party Claim

This means filing a claim directly with the at-fault driver's insurance provider. To strengthen your case, ensure the accident report and any gathered evidence clearly demonstrate their liability.

Considering Legal Action

If negotiations with the insurance company don't pan out, you might need to consult a lawyer. Believe it or not, sometimes a simple letter from a legal representative can motivate quicker settlements.

Managing the Fallout

Accidents are stressful, but managing post-accident responsibilities without insurance adds a unique layer of pressure. Here are some practical tips:

- Track all communications regarding claims. Keeping records is crucial.

- Consider setting up a payment plan if you're liable for costs.

- Plan financially for potential legal expenses, or explore pro bono options.

If you're feeling overwhelmed, remember you're not alone. Many have navigated these waters before and there are resources available to help you manage this challenging situation.

Moving Forward

While dealing with an accident as an uninsured driver can be a huge headache, it's an opportunity to reassess your insurance choices. Consider setting up a payment plan for future coverage—a lesson well learned is a step towards better preparedness.

Have you ever found yourself in a similar situation? Or do you have tips on managing the post-accident chaos effectively? Share your thoughts—it might just help someone else down the road!