Navigating College and Investment: A Balancing Act Worth Mastering

Discover practical steps to balance college expenses and investing.

Heading back to college but wondering how you can start investing while juggling tuition and textbooks? You're definitely not alone in this! A friend once told me about his experience – every time he paid for a new textbook, it felt like watching a tiny fortune slip through his fingers. Yet, he managed to navigate the choppy waters of college finance and learn the ropes of investment without sacrificing one for the other. How did he do it? With a little bit of planning, determination, and a dash of creativity.

Craft a Functional Budget

Let’s start simple: crafting a realistic budget. It might seem mundane, but this is your foundation. Break down your expenses into categories – tuition, books, living expenses, and yes, your coffee fund too.

- Determine essential vs. non-essential spending

- Set aside a fixed amount for savings

- Consistently track your spending

With these insights on paper, it’s easier to identify areas you can cut back on. Maybe skip a night out each month in favor of a quiet night with a homemade dinner? These little adjustments can free up funds for investment.

Investing for Beginners: Starting Small

Next on your finance journey is stepping into the world of investments. You don’t have to dive headfirst into the stock market. Start small.

Utilize beginner-friendly platforms like micro-investing apps. Even investing small amounts can teach you how the market works. Educate yourself on the basics of stocks, mutual funds, and ETFs. Remember, investing is a learning curve, not a sprint to instant wealth.

Setting Long-Term Financial Goals

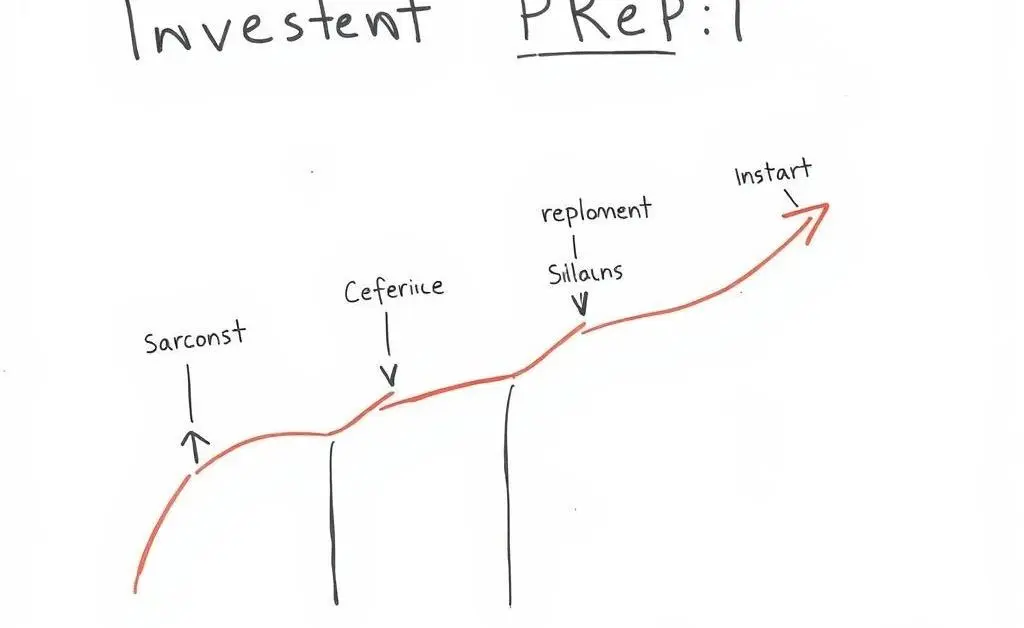

Having goals can give your saving and investing a sense of direction. Are you saving for a dream trip, thinking about graduate school, or maybe your future home? Creating a roadmap keeps you motivated.

Break down your goals into achievable milestones. This approach makes the bigger goals feel more accessible. The future feels less daunting when you have a plan to guide you.

It's a Balancing Act

Juggling college with personal finance can seem overwhelming at first, but by setting a budget, taking baby steps with investing, and setting eye-catching goals, you can thrive in both worlds.

What are your thoughts on finding financial balance while studying? I'm curious to hear how you plan to approach it or if you’ve mastered another strategy altogether!