Navigating Consumer Financial Protection: What You Need to Know

Discover practical insights to leverage consumer financial protection for your financial well-being.

Hey there! Have you ever felt a bit overwhelmed by all the financial advice flying around these days? You're definitely not alone. Whether you're navigating credit card options, considering a loan, or just trying to understand your financial rights, a little clarity can go a long way. Today, let's dive into some practical ways to leverage consumer financial protection to better your financial health.

What is Consumer Financial Protection?

Simply put, consumer financial protection is all about ensuring you, the consumer, are treated fairly in the financial marketplace. From helping you make informed decisions to guarding against unfair practices, there's a lot on the table.

How Does It Affect My Daily Life?

If you're using a credit card, dealing with loans, or making any financial transactions, consumer financial protection is working in your favor. It's there to ensure the terms are transparent, options are clear, and your rights are respected.

Know Your Rights Before Signing

Before you sign up for a new credit card or commit to a mortgage, make sure you've read the fine print. There's often more to lenders' terms than meets the eye. Understanding your rights and the product terms will save you from future headaches.

The Tools You Should Know About

There are several tools designed to help you stay informed and protected:

- Credit Reports: Regularly check your credit report. It's a snapshot of your financial health and impacts your ability to borrow.

- Financial Advisors: Consulting with an advisor can provide tailored advice, especially for complex financial situations.

- Online Resources: Websites like the Consumer Financial Protection Bureau (CFPB) offer valuable insights and tools.

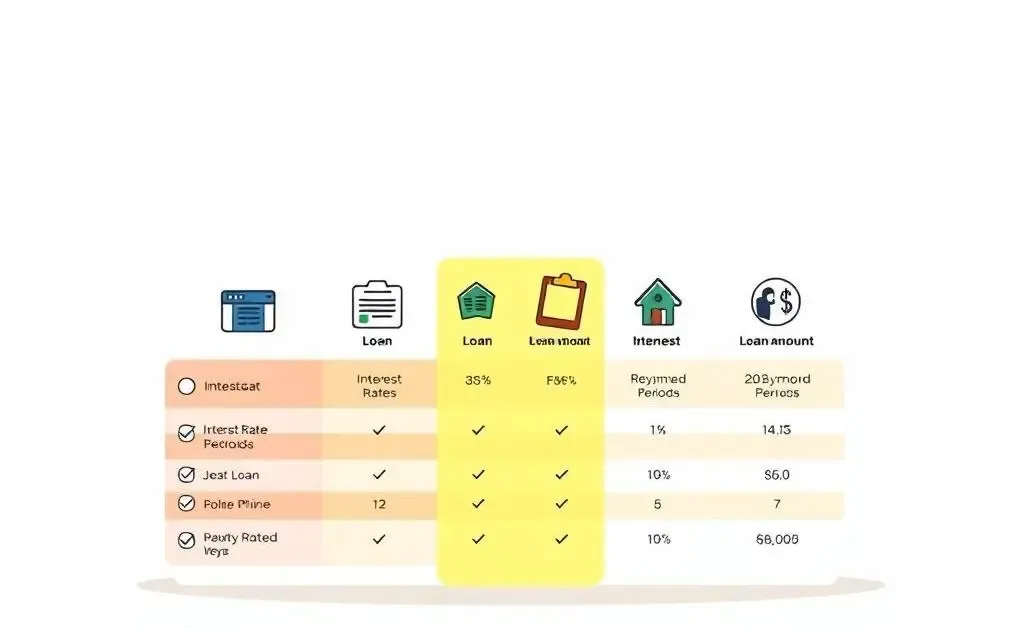

Understanding Loan Options

When considering a loan, recognize that not all options are created equal. Evaluate the interest rates, terms, and conditions carefully. Remember, low monthly payments might sound enticing, but they often come with longer terms and higher total costs.

Final Takeaway

Ultimately, consumer financial protection serves as a safeguard, empowering you to make informed financial decisions. As you navigate through various financial options, being aware of your rights and terms is key. What financial protection strategies have you found most helpful? Let's chat in the comments!