Navigating Credit Card Approvals: Insights and Tips for Success

Unlock the secrets to a successful credit card application with expert tips.

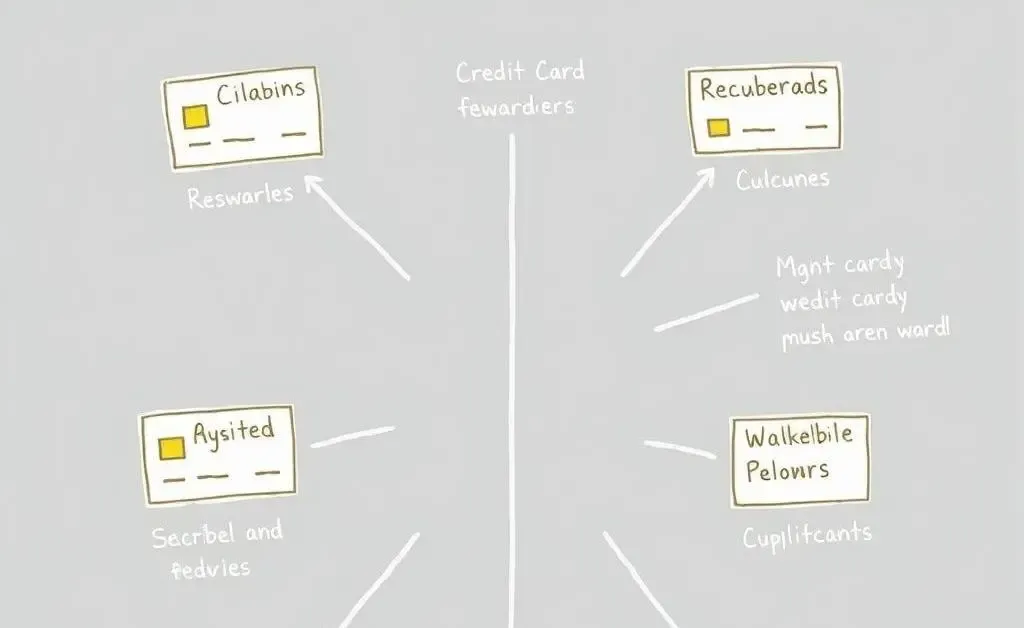

Are you ready to unlock the world of credit card benefits but unsure where to start? Let's dive into the insights that can guide you to a successful application! Whether you're looking for travel perks, cash back, or balance transfer opportunities, understanding the approval process is key.

Why Credit Scores Matter

Imagine this: you've spotted the perfect credit card with amazing travel rewards and perks, but after you apply, you're met with an unexpected rejection. It's a common scenario, and often the missing piece is the applicant's credit score.

To increase your chances of getting approved, prioritize the following steps:

- Check your credit score regularly and aim for high scores.

- Understand your credit card's minimum score requirement.

- Review your credit report for errors.

Strategically Choose Your Card

Choosing the right card isn't just about the rewards; it's about the fit. Think of it like finding the perfect pair of jeans.

Consider:

- Annual fees: Are the benefits worth it?

- Rewards categories: Do they match your spending habits?

- Sign-up bonuses: Can you meet the spend requirements to unlock them?

Manual Underwriting and Other Nuances

Sometimes credit card approvals involve more than algorithms. Manual underwriting is a deeper look into your personal financial situation. So, don't fret if you're asked for additional documentation. It might just work in your favor!

Pro tip: Prepare to showcase aspects of your financial stability, such as steady income or low debt ratios.

Anecdote: Samantha's Travel Journey

Samantha had long dreamt of traveling around the world, but finances were always tight. One day, she discovered the opportunity credit cards presented with travel rewards. After researching her options, she applied and patiently waited. Her diligence paid off—she was approved for a card that earned her those much-coveted airline miles. With time and strategic use, Samantha found herself boarding a flight to Paris, all part of her accumulated rewards!

Parting Thoughts

Mastering the credit card approval process is more than understanding numbers; it's also about strategy and preparation. What's your next step in harnessing the power of credit cards for your financial goals?