Navigating Credit Card Rewards: Your Guide to Smart Spending

Discover tips on maximizing credit card rewards without overspending.

Have you ever wondered how to make the most out of your credit card without falling into the trap of overspending? You're not alone, and many people seek effective ways to turn everyday purchases into rewarding opportunities. Let's dive into some practical strategies to maximize those perks!

Understand Your Spending Habits

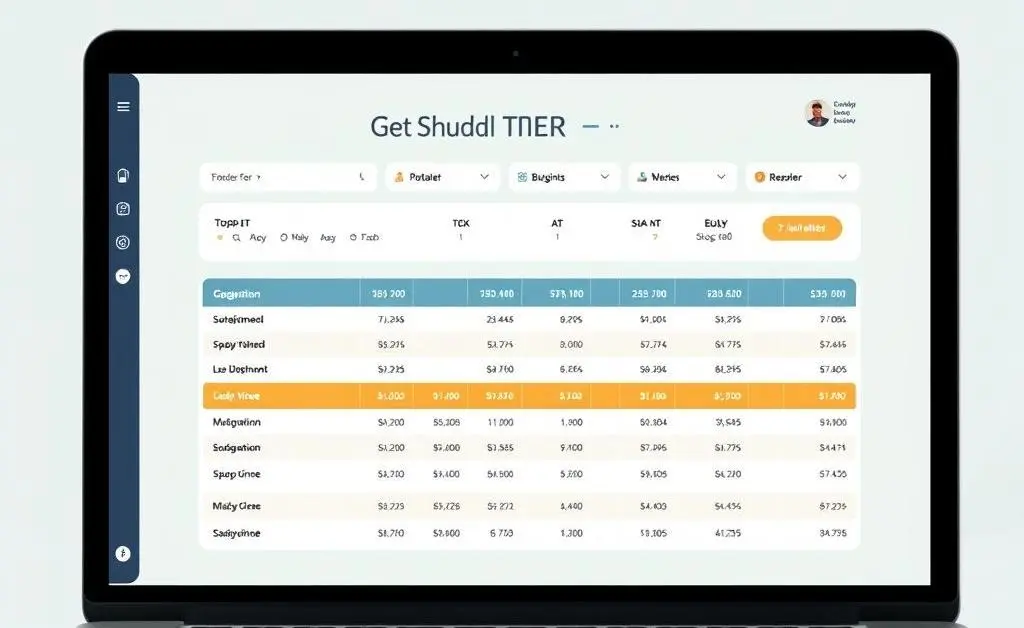

One of the first steps in this journey is to take a closer look at your spending habits. Understanding where and how you spend can help you choose the right card to maximize your rewards. A well-crafted rewards program is only useful if it aligns with your lifestyle.

Tip: Start with a Budget

Creating a budget is not just about cutting back; it's about knowing where every dollar goes. Think of it as a map guiding you toward your financial goals. Once you have a clear view of your expenses, you'll naturally spot areas where you can earn the most points.

Choose the Right Rewards Program

Selecting the ideal rewards program often resembles finding the right pair of shoes. Comfortable, reliable, and perfectly tailored to suit your needs. Here’s how you can choose:

- Travel frequently? Look for travel rewards that convert spending into flights.

- Shop at a particular store regularly? Retail-based rewards might be your match.

- Prefer cash back? Opt for cards offering high percentages in categories you frequent.

Avoid Pitfalls of Overspending

Ah, the allure of extra points at the cost of unplanned purchases can be all too tempting. Remember the old saying, "A penny saved is a penny earned"? It’s crucial to stay within the budget you’ve established. Here’s a little story:

A friend of mine loved earning travel points with every purchase. But one month, attracted by the promise of doubling her points, she ended up buying things she didn’t really need. Her trips did become more luxurious, but it took a toll on her finances. So, a lesson learned: rewards should not lead to overspending.

Plan for the Long Term

Consider this your financial strategy rather than a sprint toward a perk-filled short-term goal. Think about where you envision your rewards taking you in five years and adjust your spending accordingly. Planning can transform your points into dream trips, meaningful gifts, or valuable savings.

Are you ready to embark on this rewarding journey? What financial goals could credit card points help you achieve in the coming years?