Navigating Credit: Your Guide to Building and Maintaining a Strong Score

Unlock the secrets to building and maintaining a strong credit score effortlessly.

What is a Credit Score and Why Does it Matter?

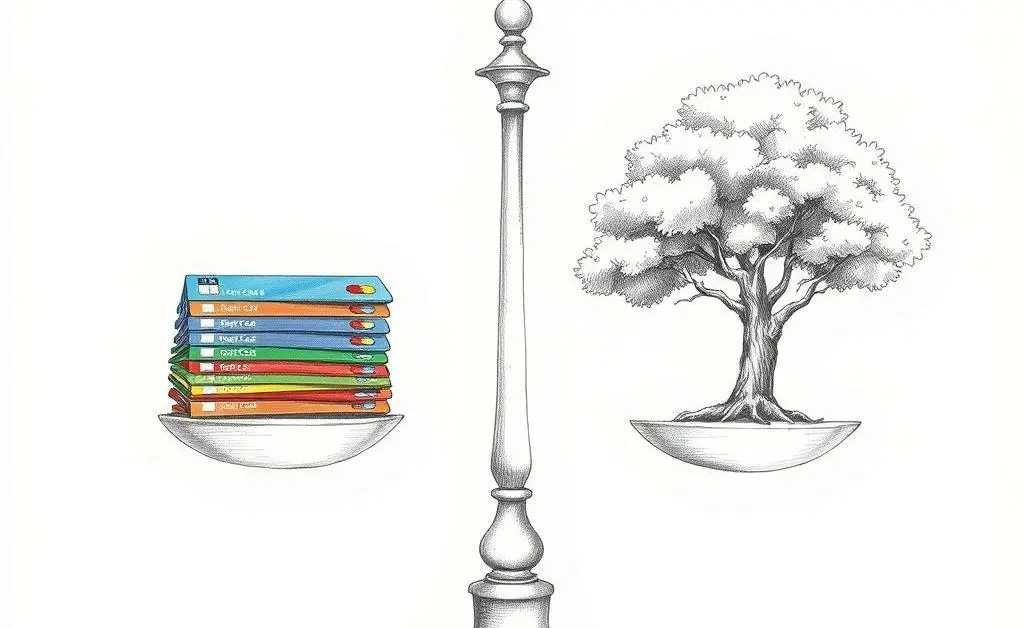

Let’s start from the top. A credit score is a number that represents your creditworthiness. Think of it as a trust metric; lenders use it to decide if you’re a safe bet. Your score can affect everything from loan approvals to interest rates, which is why it’s crucial to maintain a healthy one.

How to Build Your Credit

Building credit from scratch might seem daunting, but it’s all about strategic steps. Here’s how you can start:

- Get a Credit Card: A secured credit card can be a good starting point. Just make sure to pay it off in full every month.

- Become an Authorized User: This allows you to 'piggyback' on a responsible user’s credit behavior.

- Take Out a Small Loan: Consider a small personal or auto loan, but ensure it’s within your repayment ability.

Maintaining a Healthy Credit Score

You’ve got your credit score up, now it’s about preserving it. Here are some tips:

- Pay on Time: This is non-negotiable. Late payments can significantly damage your score.

- Keep Credit Utilization Low: Aim for using less than 30% of your credit limit.

- Regularly Check Your Credit Report: Look out for any errors that might drag your score down inadvertently.

Common Credit Myths Debunked

There’s a lot of misinformation out there about credit. Let’s clear up a few things:

- Checking Your Score Hurts It: Only hard inquiries affect your score. Checking your own credit report is a soft inquiry and does no harm.

- Closing Old Accounts is Beneficial: Actually, keeping old accounts open helps build a longer credit history.

- You Need to Carry a Balance: There’s no need to maintain a balance to improve your score; paying in full is always better.

Final Thoughts

Building and maintaining a good credit score is an ongoing process that can really pay off in the long run. By being aware and proactive, you can ensure your score reflects your financial reliability. Curious about your current status? Consider taking five minutes today to pull up your credit report and make sure everything’s in order.