Navigating Financial Freedom: Fixed vs. Variable Spending Strategies

Discover how to balance fixed and variable spending rules for financial freedom.

Have you ever found yourself caught in the tension between fixed and variable spending rules? The quest for financial freedom can feel like a dance between these two approaches. Today, let’s explore how a harmonious balance between fixed and variable spending can revolutionize your personal finance journey.

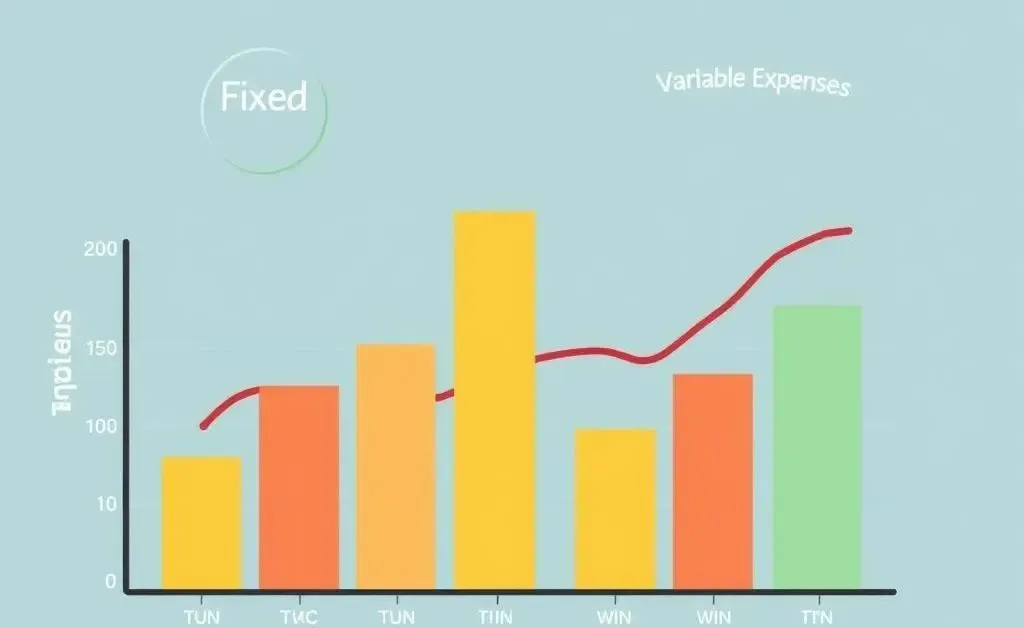

Understanding Fixed and Variable Spending

When we talk about financial management, the terms "fixed" and "variable" spending often come up. But what do they truly mean? Essentially, fixed spending encompasses expenses that remain constant each month, like rent or mortgage payments, while variable spending can fluctuate, such as groceries and leisure activities.

The Balance Act

The real magic lies in balancing these two. Imagine your finances as a garden. Fixed spending is like the sturdy trees, offering stability and shade, while variable spending represents the flowers, adding color and flexibility. Without the right balance, your financial garden might either be too rigid or too wild.

Consider Sarah, an avid traveler who struggled with her budget due to unpredictable travel expenses. By allocating a fixed percentage of her income to both travel (variable expense) and savings (fixed expense), she discovered a financial strategy that supported her wanderlust without compromising her stability.

Practical Tips for Achieving Balance

- Set a baseline for fixed expenses: Ensure your essential expenses are covered to provide financial security.

- Flex with purpose: Allow yourself flexibility with variable spending, but set limits to avoid overspending.

- Review regularly: Life changes. So should your budget. Regular check-ins can help adjust your spending according to current needs.

The Path to Financial Freedom

Ultimately, financial freedom is the goal. It’s about having the autonomy to make choices without the constraints of financial stress. Finding your rhythm with fixed and variable expenses can pave the way to this freedom, turning a potentially daunting task into an achievable goal.

So, what strategies have worked for you when balancing fixed and variable spending? I'd love to hear your insights!