Navigating Financial Milestones with Confidence

Boost your budgeting confidence with these practical tips and insights.

Have you ever felt that budgeting is like trying to solve a puzzle with missing pieces? You're not alone. While creating a budget can feel daunting, it’s one of those tasks where the payoff is genuinely worth it. Successfully managing your finances doesn’t just give you more spending power—it sets you up for future milestones and boosts your confidence in making financial decisions.

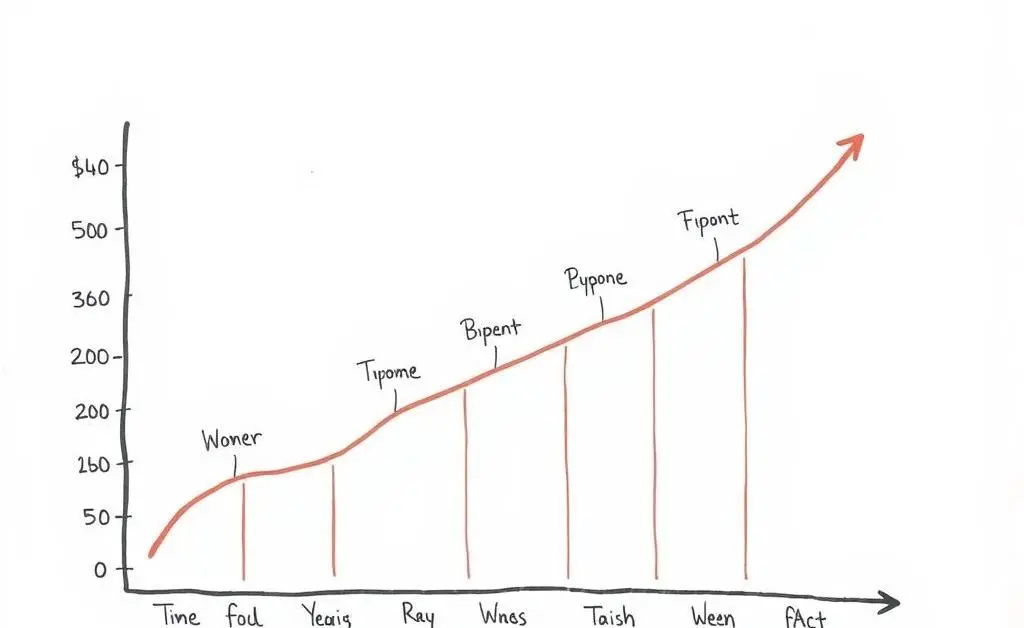

The Importance of Setting Financial Milestones

One of the most game-changing habits you can cultivate is setting clear financial milestones. These markers serve as motivators and checkpoints on your financial journey. To visualize this, imagine stepping stones leading across a river of financial chaos to the shore of stability.

Whether you're saving for a vacation, a new car, or your first home, having these milestones can provide a sense of purpose and direction. The journey may seem overwhelming at first, but trust me, every little step counts.

Practical Budgeting Tips

1. Create a Cozy Budgeting Space

Environment plays a huge role in how we handle tasks. Turn budgeting from a chore into something comforting. Set up a cozy corner with a cup of tea and soft lighting. Imagine it like a little budgeting retreat, where you can focus on making informed, relaxing decisions.

2. Start Small and Build Confidence

Dive into budgeting by starting small. Identify quick wins, like cutting out unnecessary subscriptions or planning meals for the week. These small successes provide a quick confidence boost and make tackling bigger goals feel more achievable.

3. Use Online Tools

There are countless apps and tools designed to make budgeting less intimidating. By automating savings or setting alerts for spending limits, you can maintain control without feeling overwhelmed. These tools act like guardrails, keeping you steady as you navigate your financial journey.

Confident Decision-Making in Investments

Once you've got a handle on your budget, the next step could be investments. Investing can sound scary, but with a bit of research and a lot of patience, it becomes a strategic part of your financial toolkit.

Confidence as an investor comes with time and experience. Start by educating yourself on the basics of stocks, bonds, and mutual funds. The balance scales represent finding equilibrium between saving and investing.

Conclusion

Navigating your financial path can seem tricky, but with a little patience and some strategic planning, it becomes an empowering journey. Which financial milestone are you excited to tackle next? Share your thoughts or questions below!