Navigating Financial Turbulence: Lessons from Past Economic Crises

Explore lessons from past financial crises to manage uncertainty today.

Hey there, curious minds and financial explorers! You know, history has a way of circling back, especially when it comes to economic bumps and jolts. If you've ever wondered what we can learn from past financial crises — like the famous dot-com bubble or the nail-biting 2008 financial crisis — grab your favorite cup of coffee and let's dive in!

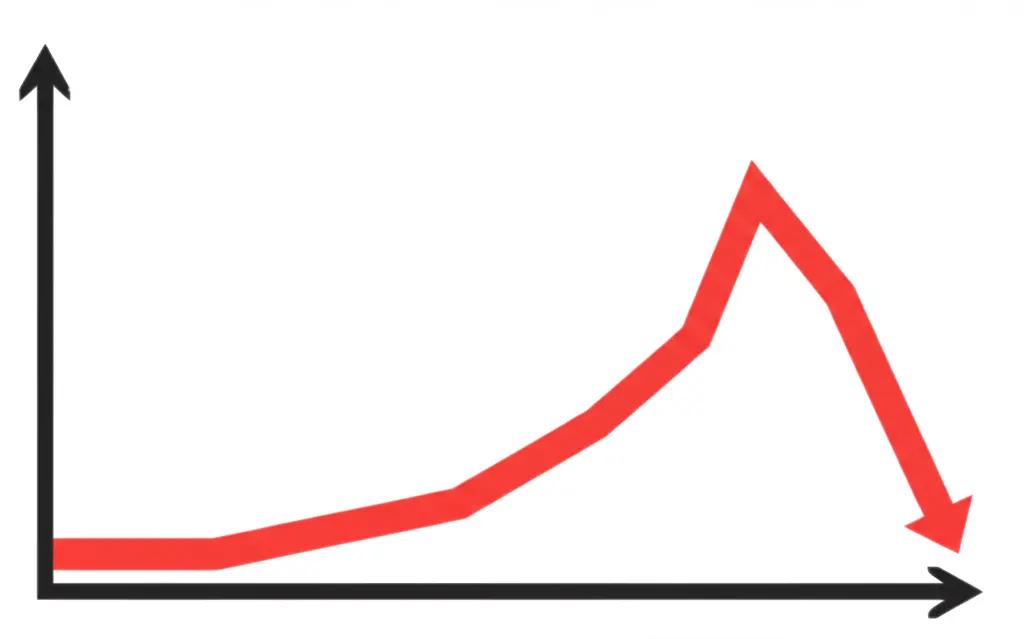

What Happened During the Dot-Com Bubble?

In the late '90s, the tech world was ablaze. Excitement over internet companies reached a fever pitch as investors poured money into startups with the hope of staggering returns. Sounds familiar, right? During those golden days, stocks soared as optimism hit an all-time high, only to crash as quickly as they had risen when many businesses discovered they couldn't deliver. The lesson here? Always check if the emperor is wearing any clothes. Investing basics still matter: a solid business plan and realized profits are vital.

Remembering the 2008 Financial Crisis

The 2008 financial crisis took on a different face, largely due to the housing market collapse. It turns out that when you give just about anyone a mortgage, things may not end well. Banks had been dealing with risky loans leading to a financial domino effect. Banks couldn’t survive, economies faltered, and people were left jobless. It taught us about the danger of complacency and the need for financial literacy. Ensuring that you actually understand how those interest rates work before signing up could save you from potential headaches.

Current Market Volatility: What to Keep in Mind

So, what about today? We're living in a world of ongoing uncertainty, especially post-pandemic. With social media amplifying every rise and dip, it’s essential to keep a clear head and a diverse portfolio. Avoid putting all your faith in a hyped-up company without understanding the fundamentals first. Balancing your investments across industries and risk profiles gets the vote for maintaining financial health.

Conclusion: Build Resilience with Wisdom from the Past

What I hope you take away from our little chat is that economic crises, while challenging, also teach us resilience and wisdom. By understanding past mistakes and smart strategies, we're better prepared to handle future uncertainties. What are your thoughts on how past lessons can guide our present and future financial decisions? Comment below!