Navigating Health Insurance Options as a Grad Student: Simple Steps and Useful Tips

Discover easy ways to get health insurance as a grad student with these practical tips.

Navigating Health Insurance Options as a Grad Student: Simple Steps and Useful Tips

Imagine this: you're a newly accepted graduate student, thrilled about the new learning opportunities, yet wondering, 'How on Earth do I figure out health insurance?' Well, you're definitely not alone in this. Health insurance is a topic that confounds many, especially when your budget is stretched thin, and you're balancing a myriad of responsibilities all at once.

Why Health Insurance Matters for Grad Students

Having health insurance isn't just a box to check off—it's a crucial safety net. We tend to think of health insurance as something primarily for emergencies, but it can also save you from unexpected medical bills that come with everyday health concerns, like allergies, check-ups, or prescriptions.

Many grad students find themselves caught in a web of questions. Where should you even begin?

- Do you need coverage immediately, or can you ride it out without?

- Which option is most wallet-friendly?

- Should you stick with your university's offering?

- What about the marketplace?

Exploring University Health Plans

One of the more straightforward options can be your university's health plan. Most educational institutions offer health plans to students. They understand the constraints of student life regarding budget and flexibility.

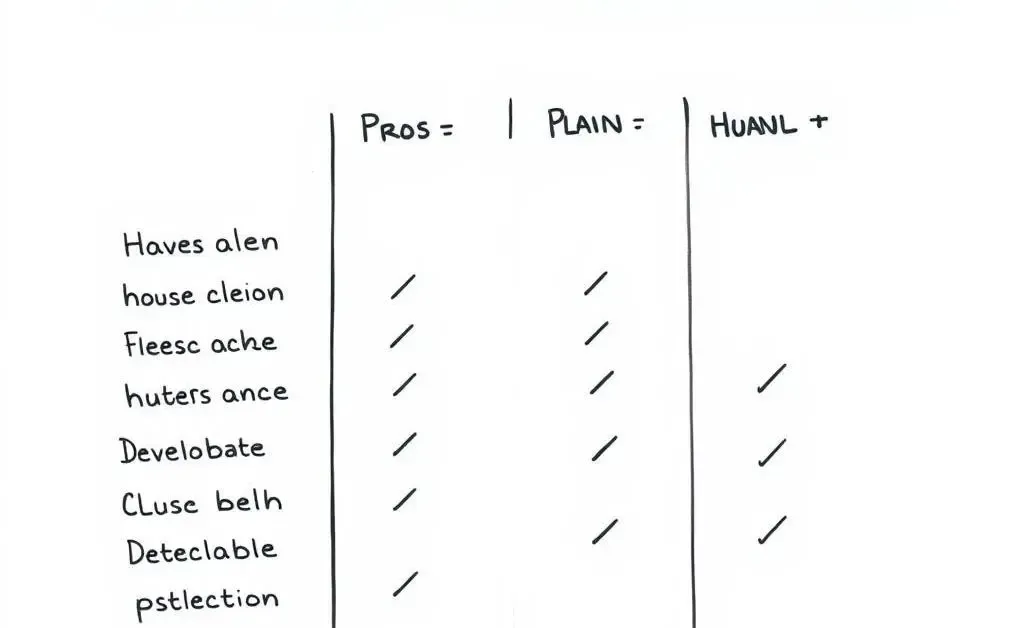

A university plan typically:

- Is integrated within your student system, making enrollment seamless.

- Offers coverage that aligns with student healthcare needs.

- Can be more affordable than other options.

Marketplace Options: A Broader Horizon

If the university plan doesn't meet your needs or budget, the next step would be to check out the Health Insurance Marketplace. This might sound daunting, but it's actually much more approachable than most think. Individuals can access a variety of plans, filtering by price, coverage, size of network, etc.

If you've never explored this route, a simple phone call to an advisor can illuminate the process significantly. You can even reach out to friends who've navigated this path before. Trust me, a small conversation can save you from a big headache later.

Relying on Family

And here's a lightbulb moment—a little-known fact is that you might be eligible to stay on a family plan until you're 26, depending on your circumstances. It's a really good idea to discuss this option with your family, as it may be the least expensive path, allowing you to focus those financial resources toward your studies.

Balancing Budgets with Coverage Needs

Remember the story of that acquaintance who opted out of health insurance, thinking themselves invincible, only to end up paying a mountain of out-of-pocket expenses because a single accident can turn plans upside down? Learning from this story, it's essential to match your health insurance choice with both your health needs and financial situation.

Budgeting might be tedious, but it's also necessary. Here's a quick tip for grasping control of your budget:

- Download a budget planner or an app to keep your expenses organized.

- Factor in potential health costs, insurance premiums, and compare with other monthly expenses.

- Adjust your coverage plan according to what you can realistically afford.

Conclusion: What's Your Plan?

In navigating the pathways of health insurance, the key is to explore your options thoroughly, asking necessary questions to align with your personal and financial situation. So, what are your thoughts and plans when it comes to your health coverage choices? Leave a comment with your experience or tips, and let's help each other out!