Navigating Health Insurance Plans: Making the Right Choice for Your Needs

Find clarity and confidence in choosing the right health insurance plan for you.

Hey there, friend! Let's talk about something that can feel a bit overwhelming but is incredibly important—health insurance. Whether you're picking a plan for the first time or re-evaluating an existing one, choosing the right health insurance can make a huge difference in your peace of mind and your finances.

Understanding Your Health Insurance Needs

Before diving into the world of premiums and deductibles, it's crucial to understand what you truly need from your health insurance. Here are some things to ask yourself: Are you expecting frequent doctor visits? Do you take regular prescriptions? What about anticipated visits to specialists for specific health conditions?

By taking a moment to reflect on your healthcare needs, you create a clearer picture of what your plan should cover. Trust me, it’s much better to have this sorted upfront!

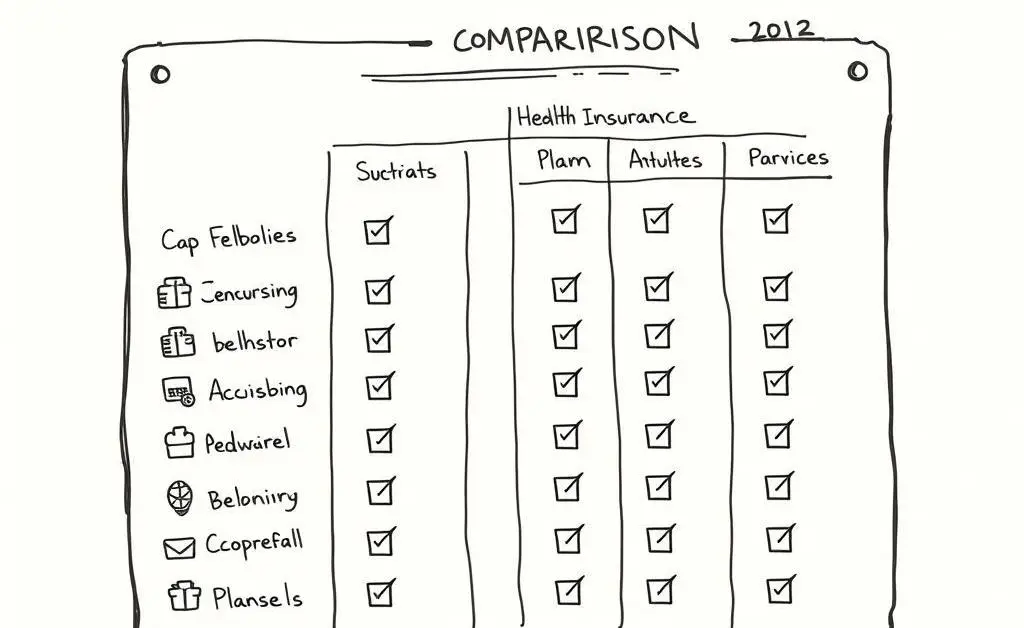

Comparing Plan Costs and Benefits

Health insurance plans often seem complex at first glance. They’re full of terms like copays, coinsurance, and out-of-pocket maximums. Here are a few key areas to focus on when comparing plans:

- Premiums: This is what you pay monthly, regardless of whether you use medical services.

- Deductibles: The amount you pay before your insurance starts to cover costs.

- Copays and Coinsurance: Your share of the costs after deductibles are met.

- Out-of-Pocket Maximum: The most you'll pay in a year.

Understanding these components helps you make an informed decision tailored to your financial and health situation.

Thinking About the Future

As you consider different health insurance plans, try to think long term. Are there any lifestyle changes you foresee, like planning a family? Or perhaps you’re entering a stage of life where more frequent health visits are likely?

By taking these factors into account, you can better align your chosen plan with potential life changes, reducing stress as the future unfolds.

Final Thoughts

Navigating the world of health insurance can feel tricky, but by approaching it with knowledge and a good sense of your needs, you can make a choice that keeps you and your wallet healthy! Remember, the right plan should offer not just coverage, but peace of mind.

Take a deep breath, consider what's important to you, and you'll be well on your way to feeling informed and confident in your decision. Here's to making empowered choices!