Navigating Health Insurance When You Need It Most

Lost health insurance on the brink of a major life event? Here's how to navigate your options effectively.

If there's one thing life loves to throw at us, it's curveballs. And losing health insurance right before a major life event? That's a slider with extra spin. Don't worry—you've got options, and I'm here to help guide you through them.

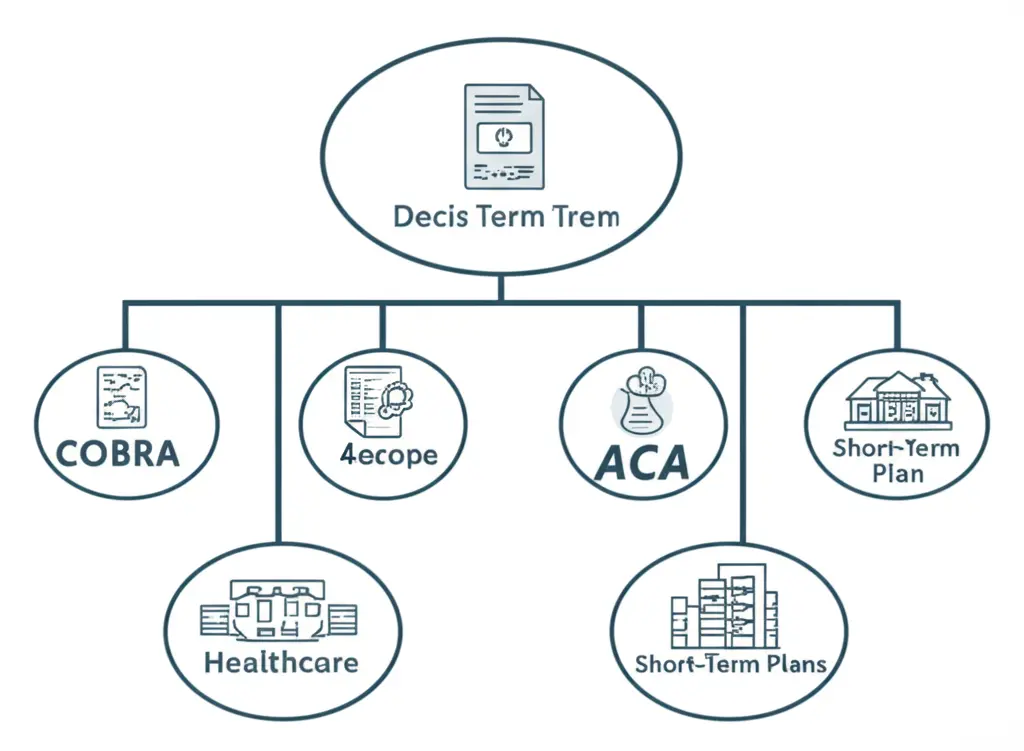

Understanding Your Immediate Coverage Options

First, let's talk about COBRA. If the rug got pulled out from under you and your job was tied to your health insurance, COBRA can provide a safety net—albeit an expensive one. It allows you to keep your employer-sponsored plan for a limited time, but you'll pay the premium entirely out-of-pocket.

Exploring the Affordable Care Act Marketplace

If the hefty price tag of COBRA isn't an option, the Affordable Care Act (ACA) Marketplace is another good route. It's crucial to check whether you're within the Special Enrollment Period, which can happen due to life events like losing coverage or having a baby.

Navigating Short-Term Health Plans

Short-term health plans can fill the gaps temporarily. They might not cover pre-existing conditions or offer comprehensive care, but they provide some financial protection. Just make sure you understand what's covered—and what's not.

Consulting an Expert Can Make a Big Difference

Sometimes, handling this on your own feels like trying to solve a jigsaw puzzle in the dark. Consulting with a health insurance broker or a financial advisor can shed some much-needed light on your situation. They're familiar with the market landscape and can offer tailored advice suited to your circumstances.

Key Takeaways

Given that you've got a lot on your plate, prioritize securing the best coverage without overwhelming yourself financially. Determine what you absolutely need—for instance, maternity care if you're expecting—and go from there.

Remember, you're not alone in this. Loads of people face similar challenges, and what truly matters is how you navigate them. Got any insurance-related stories or questions you'd like to share? Let's discuss in the comments below!