Navigating International Investments: A Personal Guide

Explore practical tips on international investing, complete with a global perspective.

Welcome to the World of International Investing

Have you ever felt like the world of international investments is a mysterious maze full of potential but also daunting complexities? You're definitely not alone! As someone who loves exploring financial opportunities beyond borders, I can tell you that this journey is both thrilling and, at times, a bit overwhelming. Let's unpack some of this together.

Why Consider International Investments?

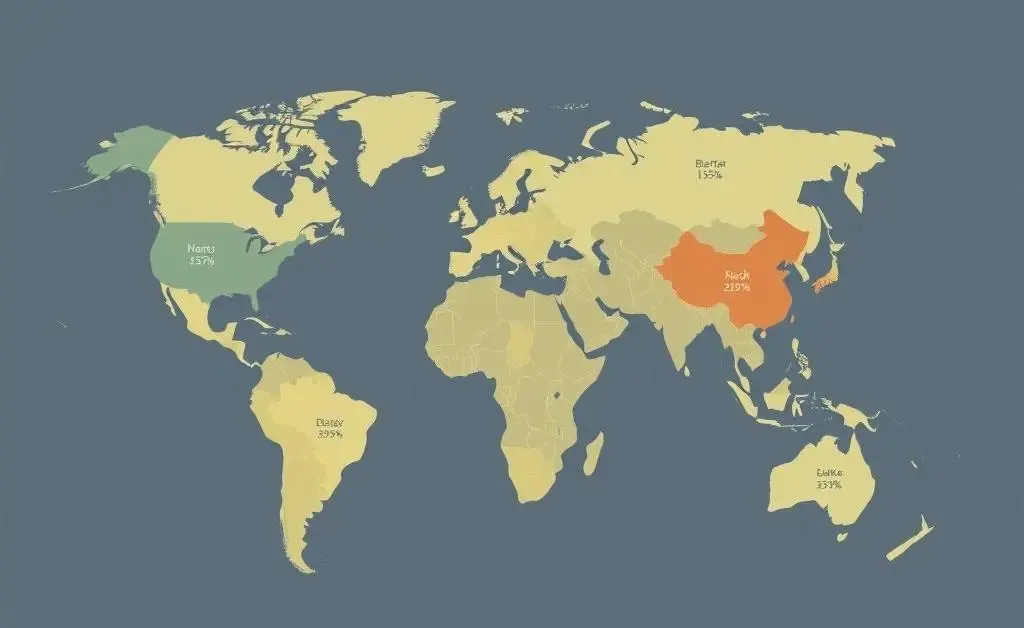

Pondering why you should even bother with international markets? The benefits range from diversifying one’s portfolio to tapping into emerging markets with promising growth. When your local economy wobbles, a global perspective can offer stability. Here’s a quick look at the pros and cons:

| Pros | Cons |

|---|---|

| Diversification of investments | Currencies risk |

| Access to emerging markets | Regulatory differences |

| Potential for higher returns | Political instability |

How to Start: A Personal Story

In my early days, I was stuck in my comfort zone until I picked up an 'Investing for Dummies' book. It talked about broadening horizons and hinted at the massive potential out there. My first step was to create an international fund account focused on ETFs, which gave me exposure to non-US markets in a manageable way.

These strategies don't remove the risks, but they allow you to taste the possibilities beyond your backyard.

Navigating the Risks

Every opportunity comes with its share of risks, especially in markets unfamiliar to us. Currency fluctuations can eat into profits, and differing regulatory environments can complicate things.

Research is key. Read up on targeted countries, understand their political climates, and assess how currency changes could affect your investments. One great resource is the Investopedia guide to international investing.

My Final Thoughts

Dipping your toes in international waters shouldn't feel like a leap off a cliff. Start small, with funds that provide a global mix. Keep a curious mindset and remain open to learning. Are you ready to embark on your global investment journey?

Investing internationally isn’t just about the potential for high returns, it's about building a portfolio that withstands the test of time and global shifts.

So, what’s next on your financial journey? I’d love to hear your thoughts and any experiences you might have in the comments below!