Navigating Investment Transfers: A Personal Journey to Financial Peace

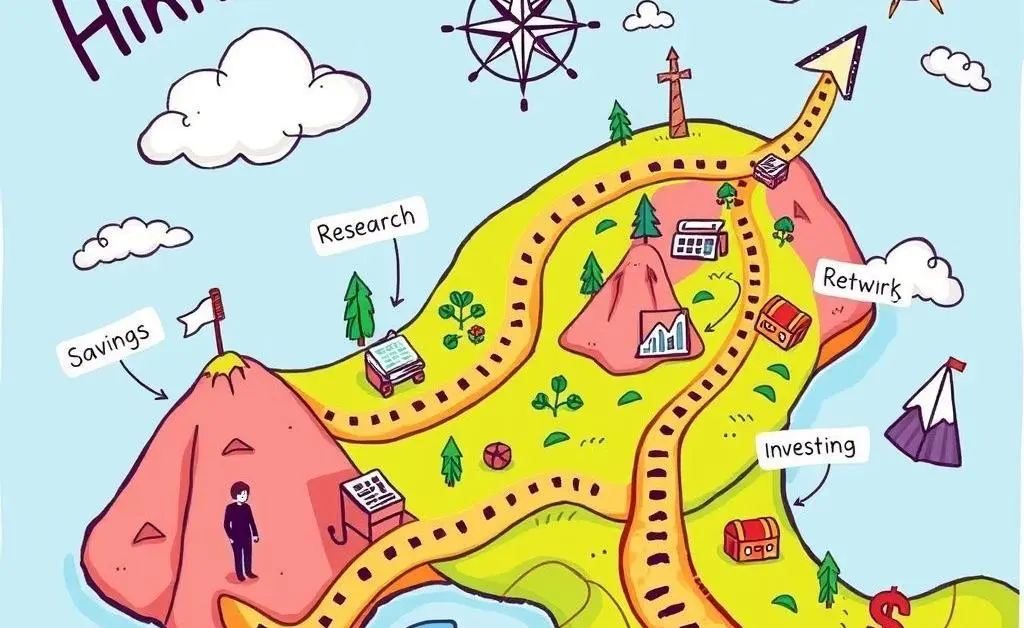

Explore intuitive steps to safely transfer investments and find financial stability.

Have you ever found yourself staring at your investment account, heart racing and mind buzzing with concern? You’re not alone. Making decisions about transferring investments, like a 401(k), can feel overwhelming. That sense of uncertainty when deciding to switch to a platform like Vanguard is something I know too well. But let me share how I turned that anxiety into assurance.

Understanding Your Investment Goals

Before diving into any investment decision, I asked myself why I wanted to transfer my funds. Was it lower fees, better service, or perhaps more control over my options? For me, it was a blend of these reasons. Understanding what I hoped to achieve helped me set clear goals and made the transition feel purposeful rather than impulsive.

Research, Research, Research

I spent time reading up on investment platforms, comparing their strengths and weaknesses. A great place to start is by checking the latest reviews and financial analyses from respected sources, ensuring a decision backed by solid information.

An Emotional Journey

It’s normal to have emotional ties to our money. After all, it's hard-earned. I often found myself thinking of my investments like seeds planted for future security, so uprooting them felt initially daunting. But by framing this transfer as a positive step toward nurturing those seeds in richer soil, I eased my mind.

Step-by-Step Transition Process

Through trial and anecdotal wisdom, here’s a simplified process to guide you:

- Evaluate current fees and compare them with prospective accounts.

- Get intimate with brokerage services and their customer support.

- Plan the timing of your transfer to avoid market fluctuations affecting your assets.

- Communicate with both current and new providers to ensure a smooth transition.

Finding Comfort in Your Decision

Remember, the goal is peace of mind in your financial future. Taking this step offers more control and clarity over your retirement planning. Each time doubt crept in, I reminded myself of the groundwork I’d laid and focused on the long-term picture—like a serene and stable landscape I was crafting for my future self.

Embracing the Journey Ahead

In the end, transferring my investments to a promising platform like Vanguard was a stepping stone to financial wellness. Whether it's about transferring your 401(k) or a different investment, making an informed, mindful choice helps transform worries into confidence. Let’s remind ourselves that each choice we make brings us closer to the tranquility we seek, knowing our future is being cared for with intention and heart.