Navigating Life Insurance: A Friendly Guide for Curious Minds

Explore life insurance with insights and tips in this engaging guide!

Hey there! Have you ever found yourself scratching your head over life insurance? You're not alone. When I first stumbled into the world of life insurance, I felt like I'd been handed a book in another language—full of terms that made my eyes glaze over. But fear not, I'm here to break it down for you in a language we both understand.

What Exactly is Life Insurance?

In simple terms, life insurance is a contract between you and an insurance company. You pay a regular premium, and in return, the insurer pays your beneficiaries a sum of money upon your death. Think of it as a financial safety net for your loved ones when you're not around. It's about peace of mind, really.

Why Do You Need Life Insurance?

Let's imagine you're the main financial provider in your family. If something unexpected happens to you, would your loved ones manage financially without your income? Life insurance aims to replace that economic void, helping to pay off debts, cover everyday living expenses, and even fund your children's education.

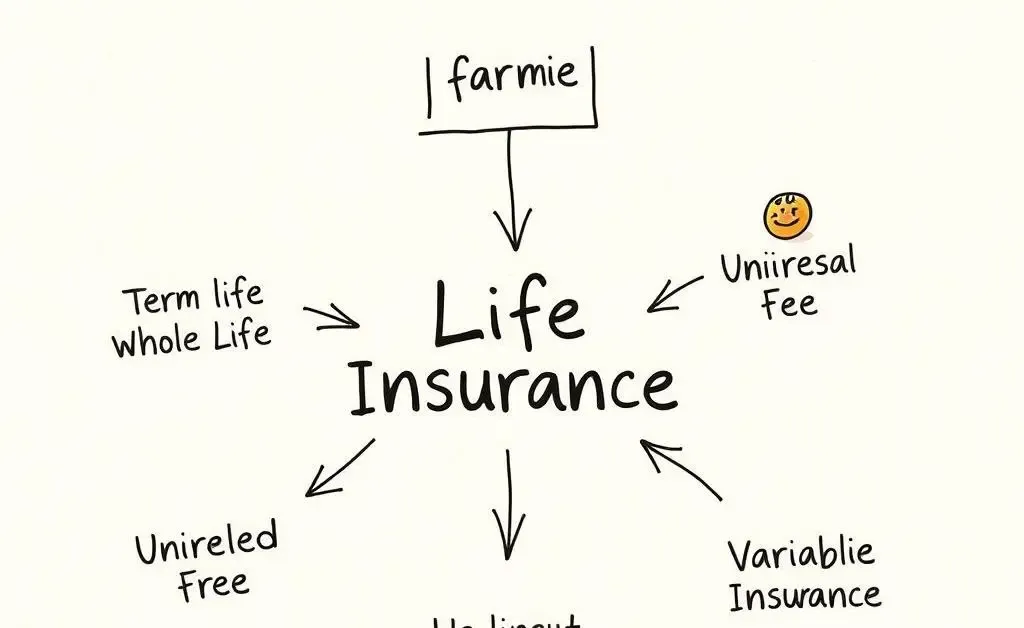

Types of Life Insurance: Decoding the Options

It might feel like there are more types of life insurance than there are stars in the sky. But fundamentally, there are two main types you should know about:

- Term Life Insurance: This is straightforward and usually the most affordable option. You choose a length of time (or term) for the coverage, say 20 years. If you pass away during this period, the policy pays out. If not, the coverage ends with no payout.

- Whole Life Insurance: As the name suggests, this covers you for your entire life, provided you keep paying the premiums. It's more than just insurance; it can also be an investment as it builds cash value over time.

Choosing the Right Policy for You

Choosing between these options depends on your needs, goals, and financial situation. If you're looking for a cost-effective backup plan for a specific time, term life might be your best friend. However, if you want lifelong coverage with the added benefit of cash value, whole life could be the one.

Getting Started with Life Insurance

Ready to dive in? Start by assessing how much coverage you need. A good rule of thumb is to consider six to ten times your annual income. Next, think about how long you'll need the coverage. Then, get quotes from reputable insurers to find a plan that fits your budget and needs.

Remember, the key is to tailor your policy to what best supports your financial plan. It might seem daunting at first, but with a little research and the right questions, you'll be well on your way to making a confident decision.

Conclusion: Your Financial Safety Net

Life insurance isn't just about dollars and cents; it's about safeguarding the well-being of those you care about. If you've been putting off this decision, take today as your starting point. You'll be glad you did.

Do you have any questions or personal insights on choosing life insurance that you'd like to share? I'd love to hear your thoughts!