Navigating Mortgage Rates: What You Need to Know

Discover key insights to help you understand and negotiate mortgage rates effectively.

When it comes to buying a home, understanding mortgage rates can feel like trying to decipher an ancient language. But don't worry, I've been there too, and I'm here to help you navigate the sometimes-murky waters of mortgage rates.

What Exactly Are Mortgage Rates?

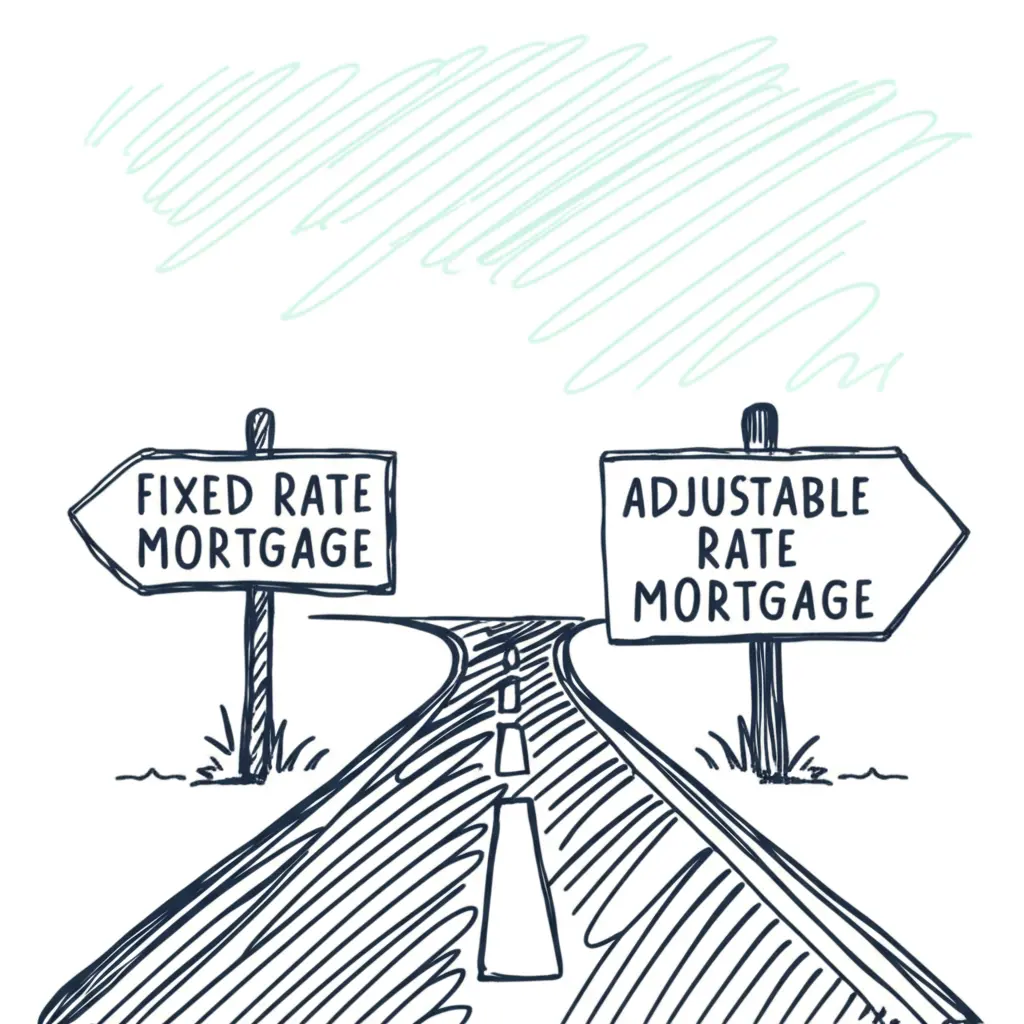

So, what are these infamous mortgage rates we keep hearing about? Simply put, a mortgage rate is the interest rate you'll pay on the loan you take out to buy a house. There are different types of rates, including fixed and adjustable rates, each with its own pros and cons.

Fixed vs. Adjustable Rates

Fixed rates: These remain constant over the life of your loan. They offer stability and predictability in your monthly payments, which can bring peace of mind. Adjustable rates: As the name suggests, these rates can change, usually based on an index plus a set margin. You might start with a lower rate, but there's potential for it to increase over time.

How Can You Get the Best Rate?

Great question! Getting the best mortgage rate often boils down to a few key factors: your credit score, the size of your down payment, and the overall size of the loan compared to the home's value. It also pays to shop around and get quotes from multiple lenders.

Don't Be Afraid to Negotiate

Believe it or not, mortgage rates aren't always set in stone. Many people don't know that the rate they're initially quoted can be negotiated. Get comfortable asking questions and don't shy away from pushing back a bit if it means landing a better deal.

Common Misconceptions

One big misconception is that the quoted rate is what you'll end up paying. Keep an eye out for any additional fees and make sure to get a clear understanding of what your quote includes. Another myth? That your rate won't change if the market dips. With an adjustable rate, you could benefit from a future rate drop, but it's important to be prepared for the opposite scenario as well.

Final Thoughts

At the end of the day, understanding mortgage rates is about playing the long game. It's about knowing what you're getting into and making informed choices that suit your financial health and life goals. Have you had any surprising experiences with mortgage rates? I'd love to hear your stories in the comments below!