Navigating Mortgages in Canada: Tips and Tricks for First-Time Home Buyers

Explore practical insights on Canadian mortgages with our engaging first-time homebuyers guide.

So, you’re thinking about buying your first home in Canada. That’s exciting, nerve-wracking, and let’s be honest—a little confusing. I’ve been there, and I know that jumping into mortgages can feel like learning a new language. What does this rate mean? Which mortgage term is right for me? Let's dive in and make sense of those swirling questions together.

Understanding the Mortgage Basics

First off, let’s chat about what a mortgage actually is. Simply put, it’s a loan specifically used to purchase real estate. This might sound basic, but understanding that it’s anchored in the property makes a huge difference. It’s not just a piece of paper; it represents your new home.

Fixed vs. Variable Rates: What's the Deal?

One of the first decisions you’ll face is choosing between a fixed or variable rate mortgage. Think of a fixed-rate as a steady ship—your payments stay the same through the term. Perfect for those who like stability. A variable rate? Well, it’s more like a rollercoaster. Rates can fluctuate, and sometimes that can mean savings, but other times it might mean higher payments. Learn more about Canadian mortgage rates and trends.

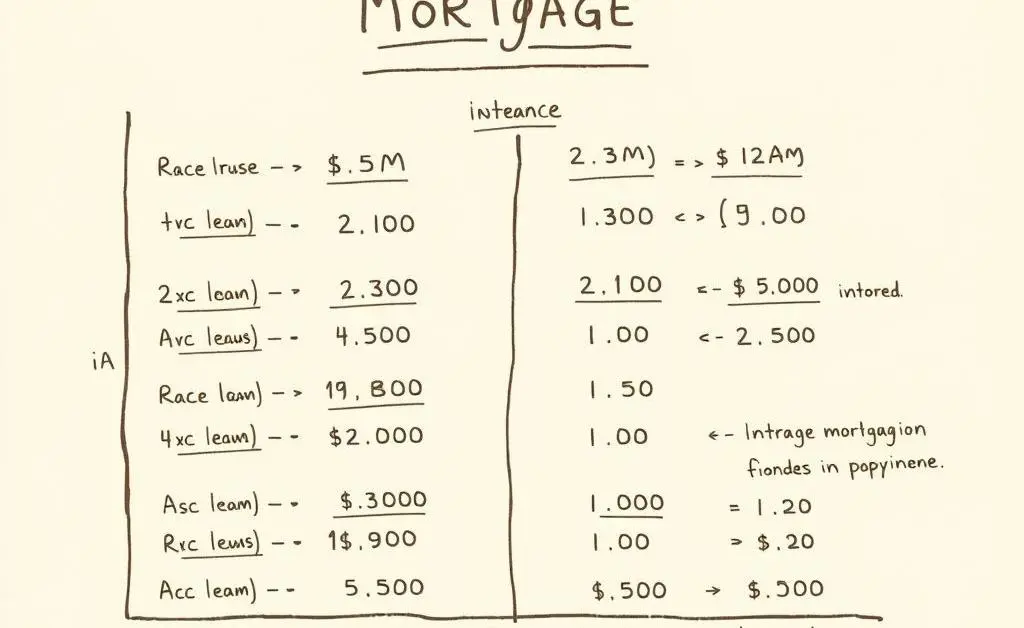

Down Payments: The First Big Step

Your down payment is the upfront amount you pay when you buy your home. In Canada, the minimum down payment is 5% for homes up to $500,000. However, if you can afford to put down more, say 20%, you can skip mortgage insurance, which can save you money long term.

Pre-Approval: Why It Matters

Getting pre-approved for a mortgage isn’t just a formality; it’s a reality check. It helps you understand how much you can actually borrow based on your current financial situation. Think of it like trying on shoes; you’ll only make the most comfortable choice by knowing what fits.

Picking the Right Lender

Choosing the right lender can feel like speed dating. Each lender has different rates and terms, and shopping around can save you loads in interest. Always consider credit unions and online lenders too; sometimes they offer competitive rates.

Final Thoughts

Mortgage shopping in Canada doesn’t have to be intimidating. Arm yourself with knowledge, ask questions, and take your time. It’s one of the most significant financial commitments you’ll make, and ensuring it’s the right fit for you will make the journey to home ownership all the more rewarding.

Have you started your home-buying journey? What’s been your biggest ‘aha’ moment so far?