Navigating Non-SEPA Transfers: What You Need to Know

Understand non-SEPA transfer fees and how to minimize costs.

Hey there, fellow financial explorer! If you've ever needed to send money outside the Eurozone, you might have run into the mysterious world of non-SEPA transfers. They can feel a bit like an unsolved puzzle, but don't worry, I've got your back!

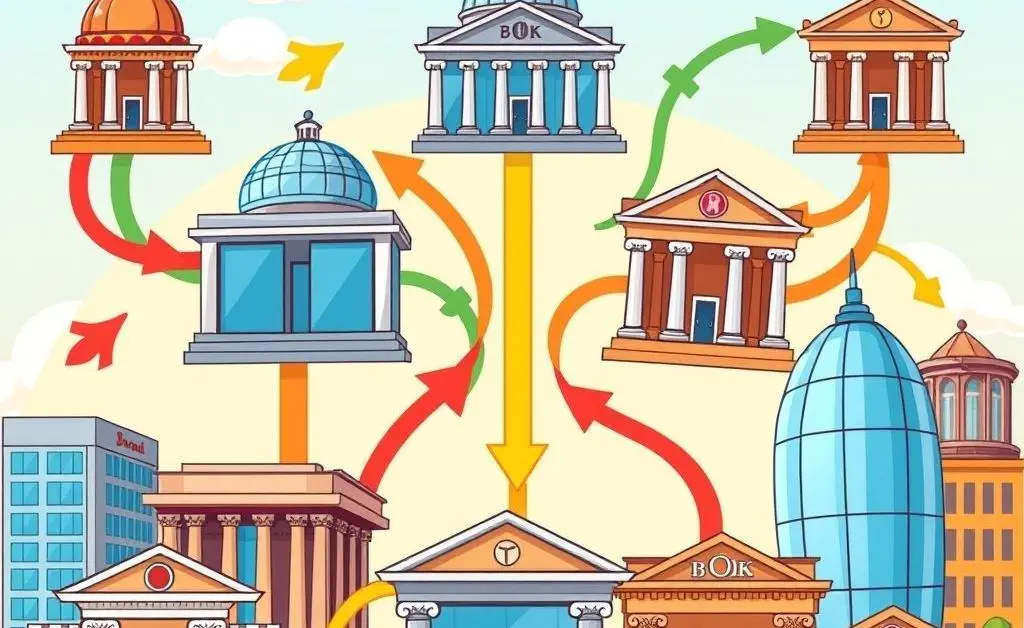

What is a Non-SEPA Transfer?

Let's start with the basics: SEPA, or the Single Euro Payments Area, makes transferring euros between European countries smooth and easy. But what happens when you need to send money to places like Canada or Japan? That's where non-SEPA transfers come into play.

Understanding Non-SEPA Transfer Fees

One of the trickiest parts of non-SEPA transfers is the fees. Unlike SEPA transfers, which are usually inexpensive or even free, non-SEPA transfers can come with various hidden costs. These can include the transfer fee from your bank, intermediary bank fees, and the exchange rate margin.

How to Minimize Transfer Costs

Want to minimize those pesky fees? Let me share some tricks:

- Compare providers: Not all banks are created equal. It might be worth checking out dedicated money transfer services like TransferWise or Revolut.

- Watch the exchange rate: Keep an eye on fluctuations and try to make transfers when rates are in your favor.

- Batch your transfers: Instead of frequent sends, consider batching payments to save on fixed fees.

Additionally, always read the fine print and ask questions if you're unsure about any fees. Your bank's customer service is there to help you—take advantage of that resource!

Finding the Right Solution for You

The path to seamless non-SEPA transfers requires a bit of research and savvy decision-making, but once you get the hang of it, it's smooth sailing! Remember, it's always good to be financially curious and informed.

I'd love to hear about your experiences with non-SEPA transfers. Have you found any clever strategies to trim those fees down? Let's swap tips in the comments!