Navigating Personal Finance: Smart Strategies for Your Money

Discover practical insights for managing personal finances and making smarter money choices.

Hey there, friend! Let’s dive into a topic that’s often on our minds but can sometimes feel a bit overwhelming: personal finance. Whether you're looking to save a little more each month or just trying to get a handle on where your money is going, I'm here to share some insight and hopefully make this whole process less daunting for you.

Why Personal Finance Matters

Managing your money is more than just paying bills and saving what's left. It's about creating freedom and setting the stage for the future you dream about. Did you know that by tracking your spending, you can make more informed decisions, reduce financial stress, and even find opportunities to invest? Here's a guide to get you started on why it matters so much.

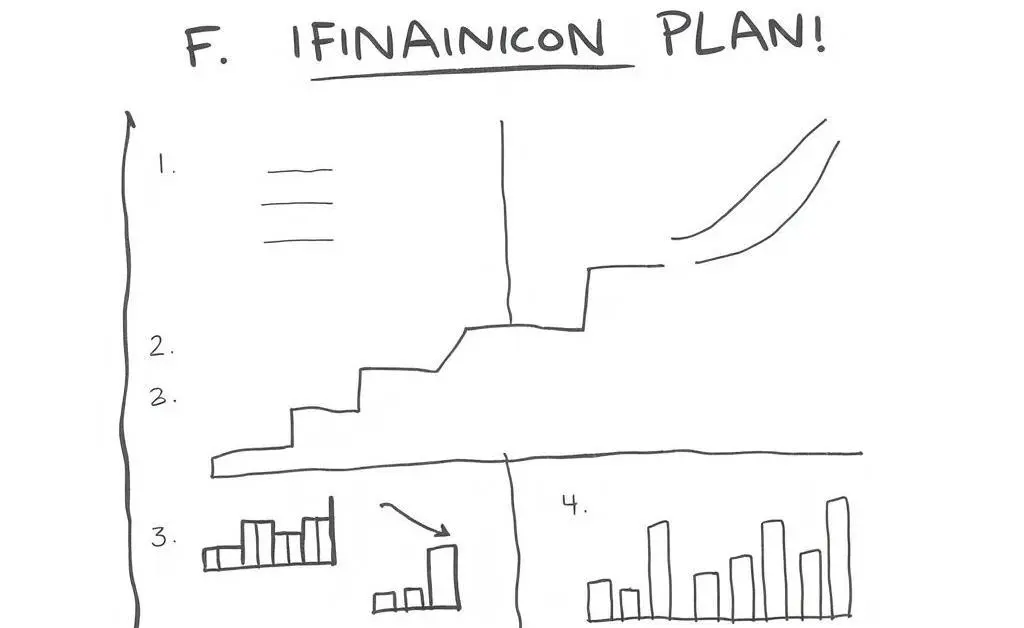

Simple Steps to Get Started

- Evaluate Your Spending: Start by taking a good look at where your money goes each month. Categorize your expenses into needs, wants, and savings. This will help identify areas where you can cut back without sacrificing what you love.

- Create a Budget: Set realistic limits based on your spending evaluation. Tools like the NerdWallet app can make budgeting easy and even fun!

- Automate Savings: Try to set up automatic transfers to your savings account each payday. It doesn't have to be much—even a small amount adds up over time.

Invest in Your Future

Once you've got a handle on the basics, think about your future goals. Is it buying a house, a nice rainy-day fund, or perhaps retiring early? Start small. Consider setting up an emergency fund and then look into simple investments like an index fund. This article dives deeper into beginner-friendly investment options.

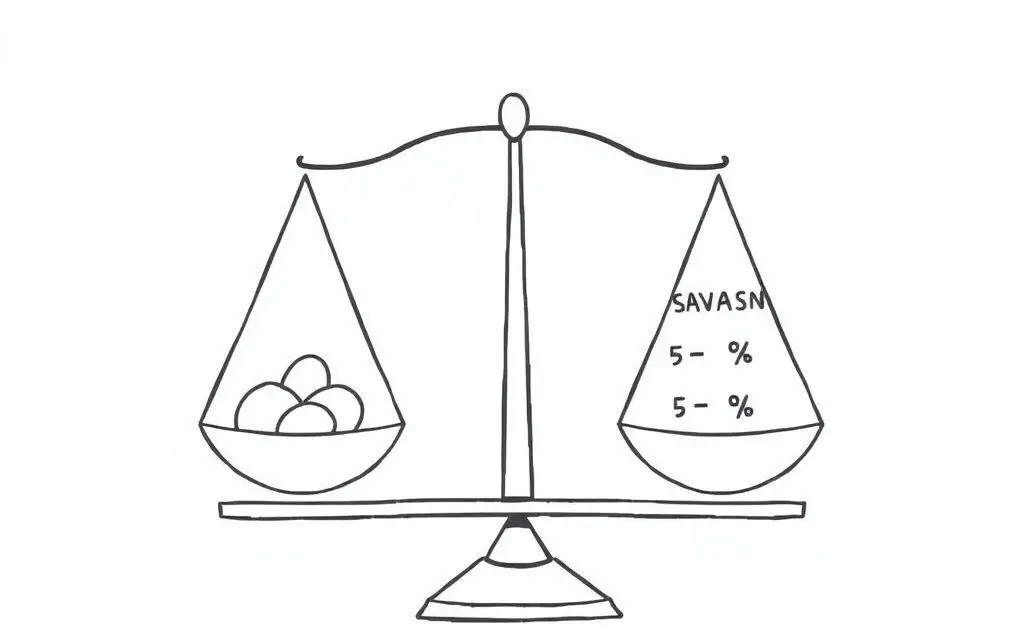

Balancing Risks and Rewards

Like life, personal finance is about balance. A risk brings the potential for reward, but it's crucial to weigh those risks. Diversifying your investments can help manage that, ensuring you're not putting all your eggs in one basket.

Conclusion

There’s no