Navigating Personal Finance: Tips for a Brighter Financial Future

Discover practical personal finance tips for a brighter, more secure future.

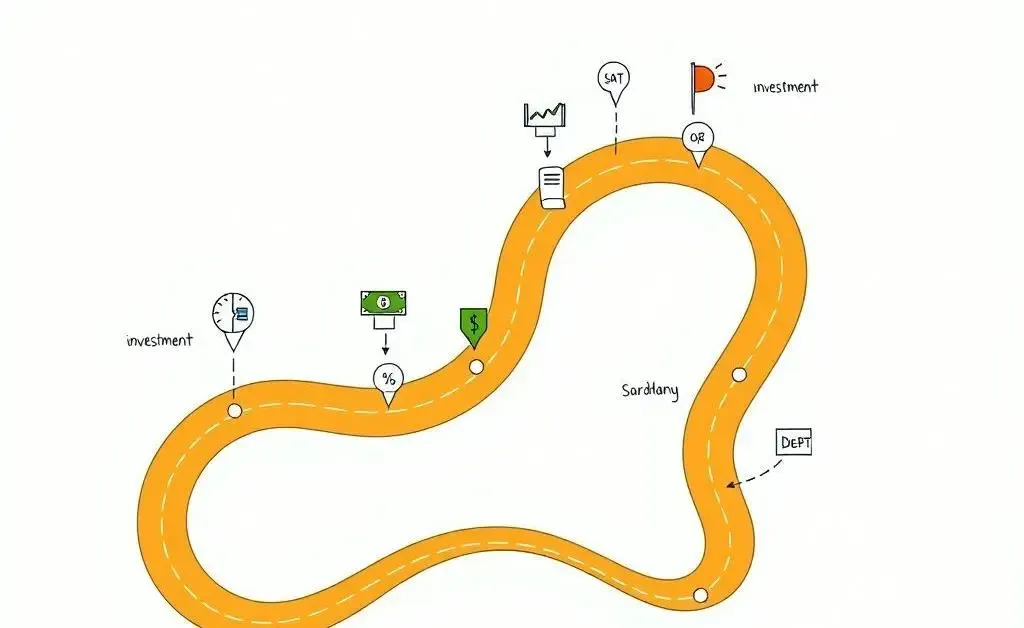

Managing personal finances can sometimes feel like trying to solve a complex puzzle. Trust me, I've been there too. But with a few simple adjustments, anyone can embark on a path towards financial stability and confidence. Let's explore some practical steps to help you build a brighter financial future.

Understanding Your Financial Baseline

The first step in managing your finances is understanding where you currently stand. This means taking a close look at your income, expenses, debts, and savings. When I first started, I found that creating a detailed budget was incredibly helpful. It allowed me to see exactly how much I could save each month and where I could cut back.

Setting Realistic Financial Goals

Once you have a clear picture of your finances, it's time to set some goals. Whether it's saving for a rainy day fund, planning a big purchase, or investing for retirement, having specific and achievable goals will keep you motivated. I often say, "Goals are the roadmaps to your dreams," and that certainly applies to your financial plans too.

The Power of Small Savings

Don't underestimate the power of small savings. Consistency is key! Even setting aside a little each week can add up significantly over time thanks to the magic of compound interest. Trust me, your future self will thank you.

Investing Wisely

Investing is a crucial aspect of growing your wealth over time. It might seem intimidating at first, but starting small with resources like index funds or mutual funds can ease you into the process. One piece of advice: always invest in something you understand. This way, you'll feel more in control and less stressed about market fluctuations.

Building a Buffer with Emergency Funds

Life is unpredictable, and having an emergency fund can provide peace of mind. Aim to save at least three to six months' worth of living expenses in case of sudden events like job loss or unexpected repairs. Knowing you have a buffer can reduce stress and help you focus on long-term goals.

Reflect and Adapt

The journey towards financial well-being is an ongoing process. Regularly reviewing your financial plan and adapting to life changes is crucial. Remember, it's about progress, not perfection.

As you embark on this journey, remember that every small step you take is a move towards a stronger, more secure financial future. What are you doing today that'll make your financial life easier tomorrow?