Navigating Personal Finance with Confidence and Ease

Embrace your financial journey with insightful budgeting and investment strategies.

Imagine this: you're sipping a warm cup of tea at your cozy kitchen table, a soft candle flickering beside you. In front of you sits a planner and a few neatly arranged financial documents. You’re setting the stage to embark on a personal finance journey, not out of necessity, but with intent and confidence.

Why Approach Finance with a Balanced Mindset?

For many of us, the word ‘finance’ can evoke a range of emotions—from anxiety to overwhelm. By aiming to create a balanced and insightful approach, the journey to financial well-being can feel more like a nurturing self-care ritual than a daunting task. One primary keyword here is personal finance. It encompasses budgeting, investing, and tracking expenses—but at its core, it’s about nurturing a sense of financial security and empowerment.

Setting Realistic Financial Goals

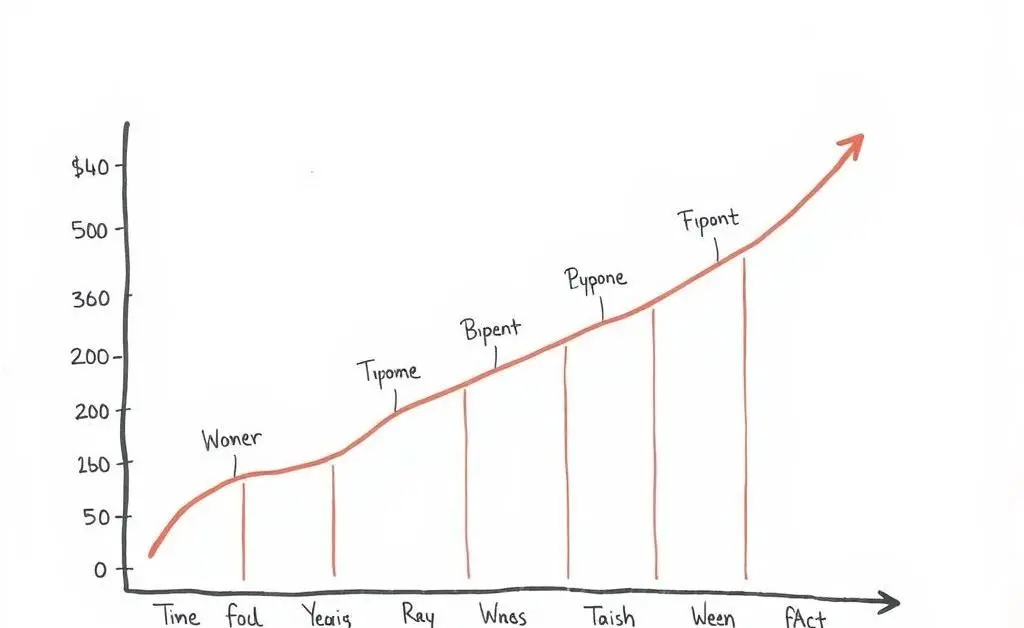

Start simple. Consider your current financial landscape and where you’d like to go. Are you saving for a vacation, a new home, or ensuring a steady post-retirement life? Writing these down can make them feel tangible and within reach, just like small stepping stones across a clear stream.

Developing a Personalized Budget

Now, let's talk budget. You need a plan so that your money aligns with your life's goals. Remember, a budget shouldn’t feel restrictive; rather, it’s a map guiding you toward your destination with room for scenic detours. Allocate funds for necessities, savings, and a little self-indulgence. Using tools like budgeting apps can simplify this process, keeping it clear and organized without the paper clutter.

Choosing Investment Paths That Resonate

Investing can seem daunting, but it can also be an exciting path to explore. Begin with an understanding of your risk tolerance and what kinds of investments align with your values and goals. Whether it's sustainable stocks or starting a retirement fund, confident decisions are about aligning investments with personal beliefs and financial comfort levels.

For beginners, consider index funds or ETFs, which offer diversification and lower risk. Using online investment platforms or consulting with a financial advisor can also provide insight and reassurance as you step into this world.

The Emotional Side of Financial Choices

It's perfectly okay to feel a kaleidoscope of emotions as you dive into personal finance. Approach each choice with self-compassion. Celebrate small wins and reflect on setbacks as opportunities for growth. Remember, this journey is uniquely yours; each step is progress toward a life aligned with your aspirations and values.

As you take this time to cut through the unnecessary and focus on what truly matters, you're not just managing your finances - you're crafting a lifestyle that supports your goals, hopes, and dreams. And that's something worth embracing wholeheartedly.