Navigating Personal Finance: Your Path to Financial Freedom

Discover personal finance essentials to help you achieve financial freedom.

Hey there, friend! Are you ready to take control of your financial journey? If you're like most of us, the world of personal finance can seem a little daunting. But don't worry, I'm here to break it down and guide you through the essentials that will lead you toward financial freedom.

Where to Start with Personal Finance

Starting your personal finance journey can feel like staring at a blank page. So, where do you begin? First, let's tackle the basics: budgeting. A budget is your financial roadmap.

Think of it as setting the GPS for your finances—without it, you might end up lost in a sea of expenses you didn't plan for.

Creating a Budget that Works for You

Crafting a budget doesn't have to be complicated. My go-to method is the 50/30/20 rule.

- 50% Needs: Ensure your essential expenses, like housing and groceries, stay within 50% of your income.

- 30% Wants: Guilty pleasures or hobbies fit here.

- 20% Savings: Prioritize emergency funds and future investments.

Remember, your budget should reflect your life and priorities. It's not set in stone. Feel free to adjust as your circumstances change.

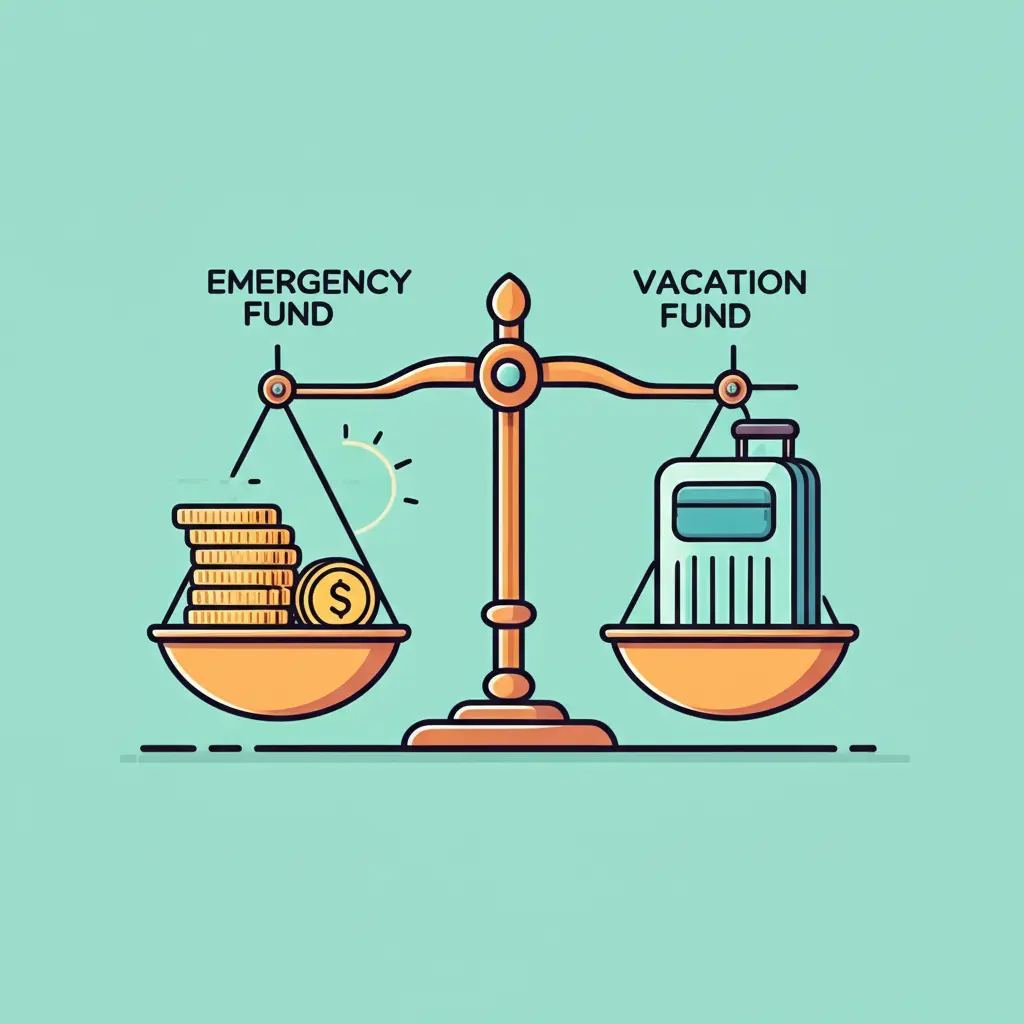

Why You Need an Emergency Fund

An emergency fund is like a seatbelt for your finances—it keeps you safe in life's unpredictable turns. Aim to save three to six months' worth of expenses in a separate, easily accessible account. Learn more here.

Investing in Your Financial Future

Once you have a solid foundation with your budget and emergency fund, it's time to think about investing. The stock market might sound terrifying at first, but don't shy away. Starting small, with options like index funds, can steadily build your wealth over time. Explore resources like Investopedia to get started.

Becoming Financially Literate

Understanding the terms and dynamics of finance is crucial. You don't have to become an overnight expert, but increasing financial literacy pays dividends. Books, podcasts, and online courses are excellent ways to learn.

I hope this has given you some useful insights into personal finance. It might seem overwhelming initially, but remember you're not alone on this journey. Every small step you take is progress. So, what’s your first financial goal going to be?