Navigating Piggyback Loans in High-Cost Areas: Smart Strategy or Financial Risk?

Explore if piggyback loans are savvy in high-cost areas. Weigh pros and cons with a friendly guide.

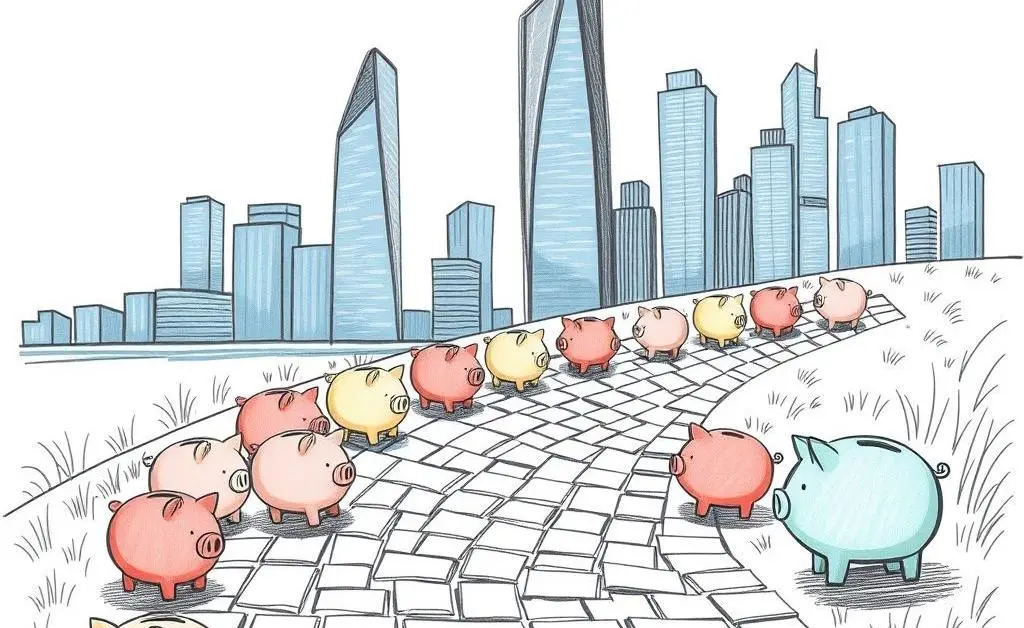

Buying a home in a high-cost area can feel like gearing up for space travel—exciting, daunting, and potentially life-altering. Have you heard about the buzz around piggyback loans? You're not alone. It's a popular topic among those aiming to enter the housing market in vibrant, bustling metros where property prices often reach stratospheric levels.

What is a Piggyback Loan?

Let's break it down in simple terms. A piggyback loan typically involves taking out two loans simultaneously. The first covers 80% of your home's value, and the second—a smaller loan—covers another 10%. The idea is to dodge private mortgage insurance (PMI) and potentially secure better mortgage terms.

If you're wondering how that works, envision a homeowner balancing on two surfboards: one represents a primary mortgage, the other the piggyback. It can be thrilling if you can keep your balance, but risky if waves (like fluctuating interest rates) swell.

Pros and Cons of Taking the Piggyback Route

- Pro: Avoid PMI - No PMI can mean saving hundreds monthly, especially in markets where home prices are sky-high.

- Pro: Potential Tax Advantages - Unlike PMI premiums, mortgage interest may be tax-deductible.

- Con: Higher Interest Rates - That second loan usually carries a higher interest rate, impacting monthly budgets significantly.

- Con: Navigating Complexity - Managing two loans demands stellar organization.

Relatable Anecdote: The Great Debate

Picture this: Sam and Jamie, a couple enthralled by the prospect of owning a city loft. They were torn between trying a piggyback loan and paying PMI. Late-night Google fests and overflowed coffee cups led them to choose the piggyback route—without understanding the varied tax landscape. Unexpectedly, the second loan’s rate ate into their savings, but over time—thanks to expert refinancing—they found steadiness. A lesson showing the need for a deep dive analysis before decision-making.

Is It Right for You?

Here's what to consider before flipping the piggyback switch:

- Your financial stability and creditworthiness.

- Current and projected interest rates.

- Your long-term homeownership goals.

- Tax implications in your area.

Piggyback loans can be a strategic tool, but they require careful thought and weighing of your unique circumstances. Consult financial experts, play with loan calculators, and discuss with your partner or family members. Financial journeys should consider all possible detours and destinations.

In your view, what's the biggest roadblock to feeling confident about big financial strategies like piggyback loans? Share in the comments below!