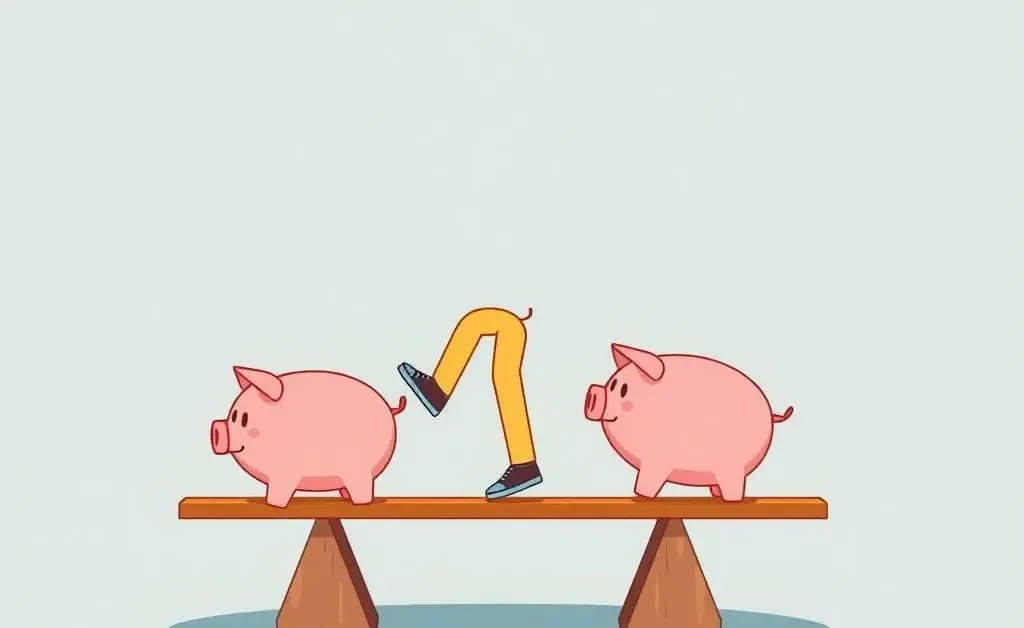

Navigating Piggyback Loans in High-Cost Living Areas: Savvy Strategy or Risky Gamble?

Explore the pros and cons of piggyback loans in expensive areas and find out if they're right for you.

Ever felt like buying a home in a high-cost living area is akin to climbing a steep mountain? For many, this journey can feel daunting. Enter the piggyback loan, a strategy some savvy buyers swear by, while others approach with caution. But is it the right move for you? Let’s dive into what these loans are all about and whether they should be part of your toolbox when buying a home in a pricey market.

Understanding Piggyback Loans

Piggyback loans, often referred to as 80-10-10 loans, involve taking out two mortgages simultaneously. Typically, you'd take out a first mortgage for 80% of the home's value, a second mortgage for 10%, and make a 10% down payment. The goal? To avoid private mortgage insurance (PMI) and potentially secure a more favorable interest rate.

The Pros of Piggyback Loans

- Avoid PMI: The golden goose of avoiding PMI is a major draw for many. This insurance can add a significant chunk to your monthly payments.

- Lower Down Payment: By splitting the mortgage, you can lower the amount you initially need to fork over.

- Interest Flexibility: Sometimes, the rates on the second mortgage can be more favorable, especially if market conditions shift.

The Potential Pitfalls

As with any financial strategy, there are risks involved. Here’s what to watch out for:

- Interest Rate Fluctuations: The second mortgage might have a variable rate, which can increase over time.

- Double Payments: Two mortgages mean two payments, which can strain your finances.

- Complex Closing Process: Juggling two loans adds complexity to an already overwhelming process.

Is a Piggyback Loan Right for You?

Imagine standing at a financial crossroad with a complex decision ahead. That's the experience many potential homeowners face when considering piggyback loans. Picture Sarah, living in a city where property prices reach for the sky. Fed up with paying exorbitant rent, she researched and decided on a piggyback loan to purchase her first condo. The process was intricate, but in her case, the savings justified the means.

But just because something worked for Sarah doesn't necessarily mean it will work for everyone. It's important to weigh the benefits against the risks and align them with your financial situation.

Your Turn to Jump into the Mortgage Fray!

Considering all, whether piggyback loans make sense boils down to personal circumstances. Are you ready to take the leap, or do traditional mortgage structures suit you better? As you navigate these waters, what are the biggest factors influencing your decision? Let’s continue this conversation in the comments below!