Navigating PMI: Steps to Minimize It and Boost Homeownership Confidence

Understand PMI, how to manage or avoid it, and empower your home buying journey.

Ah, the journey of buying a home—a milestone filled with excitement and, at times, overwhelming decisions. If you've ever stumbled across the term PMI, or been curious about how it fits into your home buying adventure, you're not alone. Let's unravel this concept together, shedding light on its purpose and how you can navigate (or even sidestep) it efficiently.

What Exactly is PMI?

At its core, Private Mortgage Insurance, or PMI, is a safety net for lenders. It kicks in when your down payment is less than 20% of the home’s price. Essentially, PMI protects the lender from the risk of you defaulting on the loan. While this might seem like an extra load on your shoulders, especially when you’re crunching numbers in your budget, PMI enables many of us to step into homeownership sooner rather than later.

Strategies to Avoid or Manage PMI

A few thoughtful steps can go a long way to minimize or avoid PMI altogether:

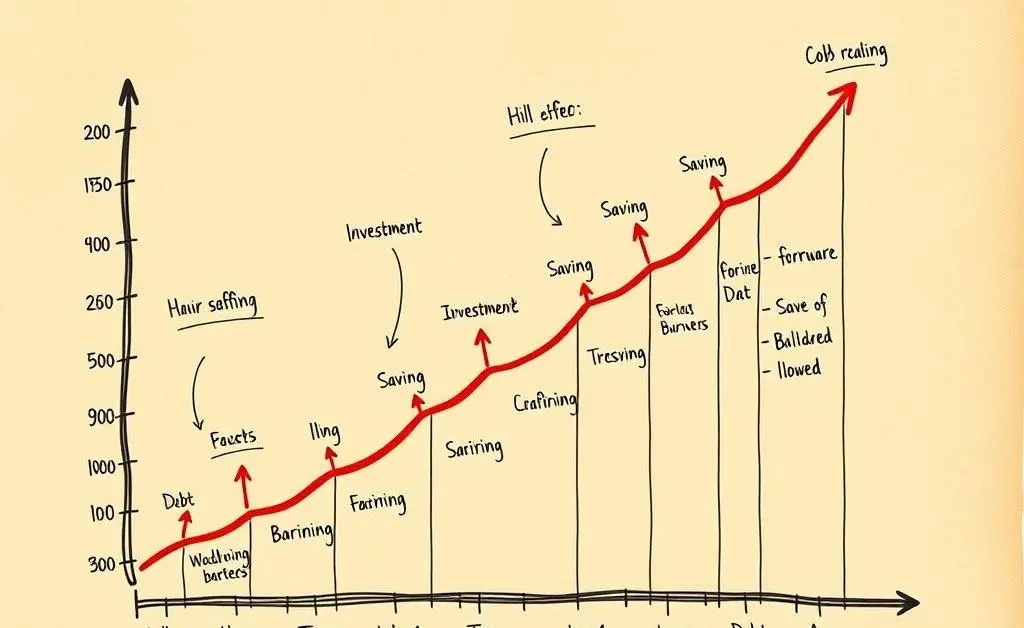

Save for a Larger Down Payment

It’s simple in theory, a bit more challenging in practice. Aiming for that 20% down payment is ideal to completely sidestep PMI. But remember, small, consistent savings can grow over time.

Consider a Piggyback Loan

Also known as an 80-10-10 loan, this involves taking out a second loan to help cover part of your down payment, thereby reducing the primary loan-to-value ratio to avoid PMI. However, it's crucial to balance this option carefully, considering interest rates and your monthly financial landscape.

Refinance to Remove PMI

As you build equity in your home, refinancing is a potential way to say goodbye to PMI. Typically, this involves reaching a point where the outstanding balance falls below 80% of the home’s current value.

Living with PMI Temporarily

If you find yourself having to pay PMI initially, think of it as a stepping stone rather than a permanent fixture. It’s a temporary cost that aligns with your larger goal: owning a home. While it's a bit like paying rent to the lender, stay focused on your long-term vision and plan for the day you can say goodbye to it.

Building Your Financial Confidence

Overall, the beauty of understanding PMI lies in its empowerment. It’s a tool in your toolkit, one that you can manage, adjust, and eventually phase out. Surround yourself with reliable advice, nurturing your financial acumen. Over time, you’ll find your balance, much like those wise scales of investment.

Take each step at your own pace, knowing that home ownership is a deeply personal journey, woven with learning, growth, and yes, a bit of paperwork too. Let’s keep the conversation going, exploring more questions you may encounter along this fulfilling path.