Navigating the 60/40 Investment Strategy: A Friendly Guide

Discover the 60/40 investment strategy and how to balance your portfolio for optimal growth.

Hey there! Ever wondered how to build a balanced investment portfolio that could weather the market's ups and downs? Let’s dive into the 60/40 strategy, a classic approach that balances stocks and bonds, and see how it might be the right fit for you.

What is the 60/40 Investment Strategy?

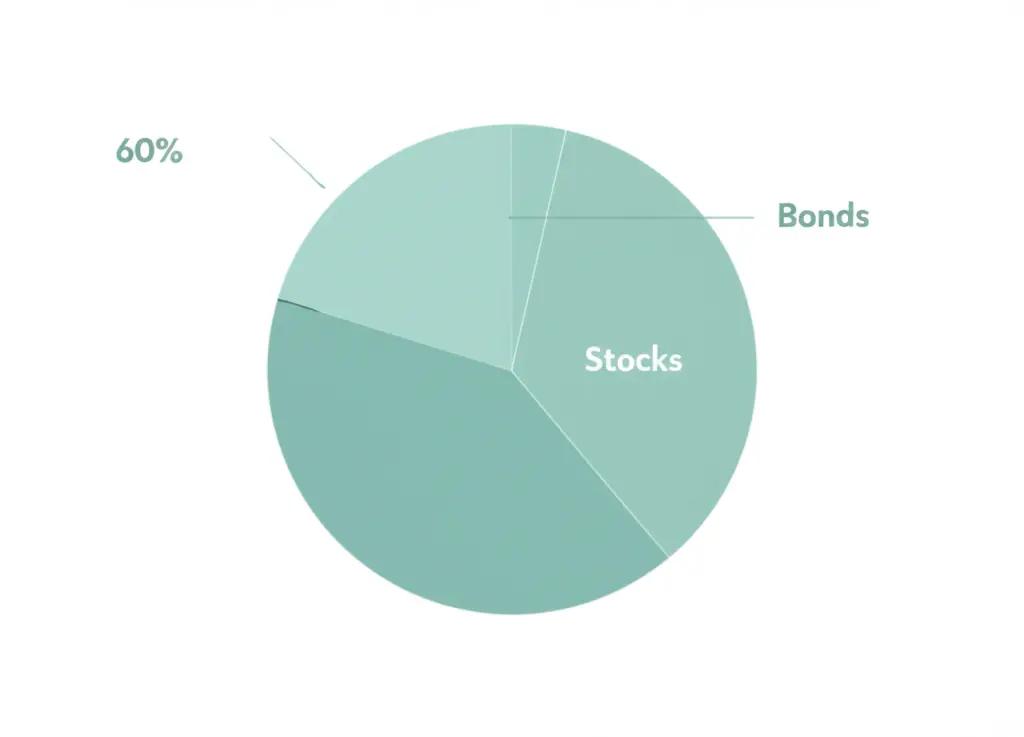

The 60/40 strategy involves allocating 60% of your investment portfolio to stocks and 40% to bonds. This method aims to capture the growth potential of stocks while using bonds to mitigate risk. It's often lauded for its simplicity and effectiveness over the long term.

Why Choose a 60/40 Portfolio?

There are several reasons investors might opt for the 60/40 approach:

- Simplicity: The split is straightforward, requiring less time to manage compared to more complex strategies.

- Risk Management: By including bonds, you can reduce the volatility that pure stock portfolios might experience. Learn more about risk management.

- Historical Performance: Historically, this strategy has provided steady returns with less risk than an all-stock portfolio. See historical data.

Is 60/40 Right for You?

Before diving into the 60/40 strategy, consider your financial goals and risk tolerance. Are you comfortable with the potential for growth balanced against the security of bonds? If your investment horizon is longer, you might experience more growth through higher stock exposure. However, if volatility makes you uneasy, the 60/40 mix might just provide the peace of mind you need.

How to Implement the Strategy

Start by reviewing your current portfolio and gradually adjusting your allocations. You might want to consult a financial advisor to help fine-tune your mix and ensure it aligns with your goals. Remember, it's crucial to rebalance your portfolio occasionally to maintain the target allocation.

In Conclusion

Investing doesn't have to be complicated. The 60/40 strategy offers a balanced approach that combines growth and security. What's your take? Do you prefer a more aggressive strategy, or does the balance of the 60/40 portfolio sing to your investor soul? Drop your thoughts below!