Navigating the Banking Maze: Answers to Your Top Questions

Uncover simple answers to common banking questions in our friendly guide.

Ever felt like the world of banking was intentionally confusing? You're not alone. Navigating banking options and understanding what works best for you can feel a bit like solving a puzzle—except the prize is your financial well-being. In this guide, I'll break down some of the most common banking questions and offer practical tips to help you make the most of your money.

How Do I Choose the Right Bank?

Choosing a bank is like picking the right pair of shoes: it's all about what fits. Consider your needs first. If you travel often, a bank with low international fees might be your best bet. Prefer face-to-face interactions? Opt for a bank with local branches. For many, a good online platform is crucial, so prioritize banks with top-rated mobile apps. I once stuck with a bank for way too long because I didn't realize what was out there. Trust me, do your homework and shop around.

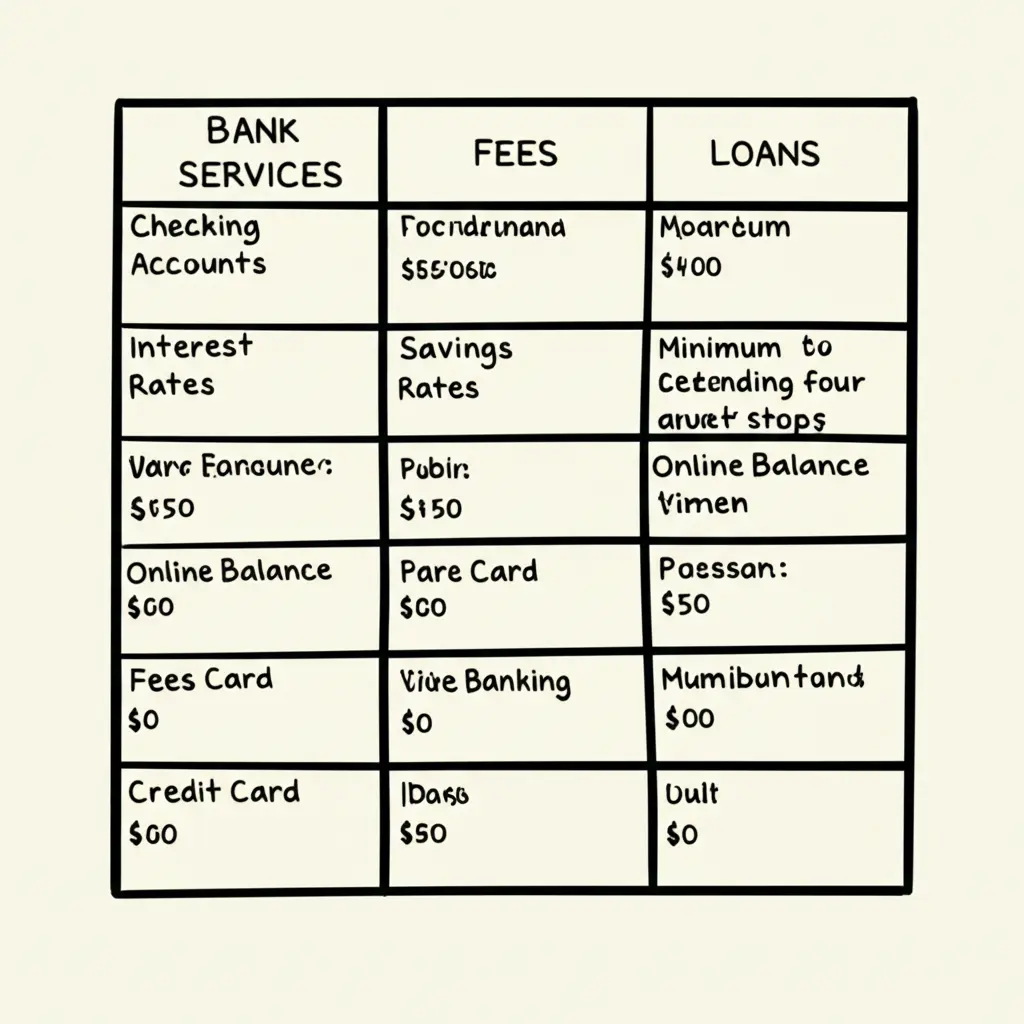

Top Features to Consider:

- Account fees and minimum balance requirements

- Availability of ATMs and branches

- Mobile and online banking features

- Interest rates on savings accounts or CDs

How Can I Save on Bank Fees?

No one likes hidden fees. They're like surprise birthday parties you didn't want. To avoid them, always check fee schedules carefully. Banks often charge for things like overdrafts, ATM use, and monthly maintenance—those can add up. One trick? Set up direct deposits or maintain a certain balance to waive fees. And always leverage in-network ATMs to dodge withdrawal costs.

What Should I Consider Before Taking a Loan?

Loans can be a powerful tool or a tricky trap. Before applying for a loan, evaluate your financial situation thoroughly. Consider interest rates, repayment terms, and your budget. Calculate how the monthly payment fits into your current expenses, and avoid loans with prepayment penalties if you plan to pay them off early. Once, I almost signed for a loan just because it sounded good on paper—but I realized the fine print was a horror story. Always read carefully.

Is an Online Only Bank Right for Me?

Online banks offer fantastic benefits, like higher interest rates and better apps. But, they lack physical branches, which isn’t for everyone. If you're comfortable doing all your banking digitally and seek high savings yields, give them a go. Otherwise, you might miss having a brick-and-mortar bank to visit.

Takeaway: Navigate with Confidence

Banking doesn't have to be baffling. By understanding what to look for in a bank and matching features to your lifestyle, you're on your way to financial savvy. Have you recently switched banks or discovered a tip that helped? I'd love to hear about it—let's learn from each other!