Navigating the Emotional Nuances of Retirement Planning

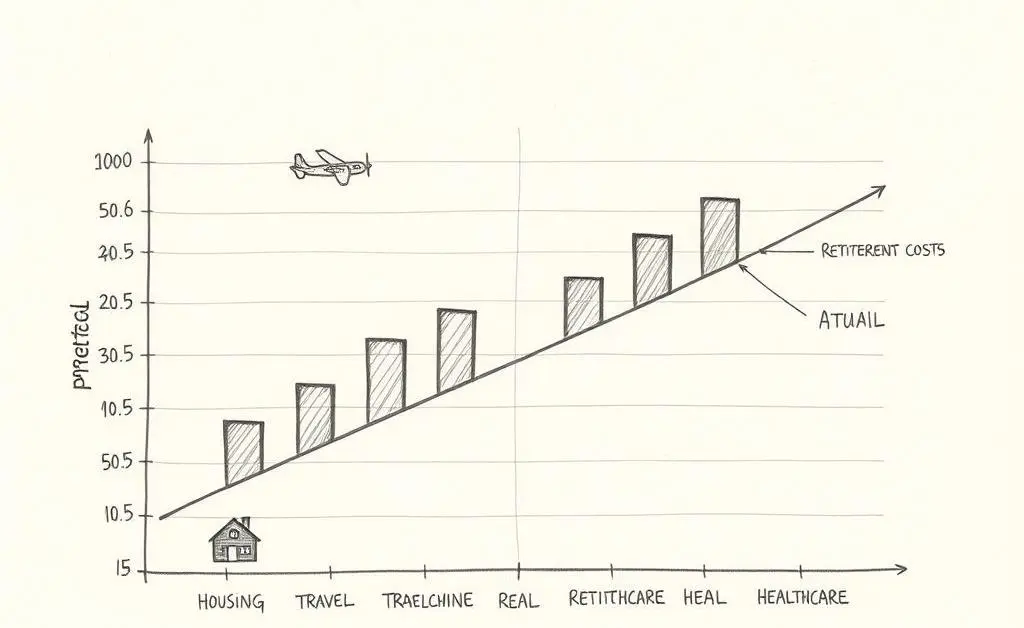

Explore the unexpected dynamics between planned and actual retirement spending.

Retirement can be a lot like that moment before you embark on a well-planned adventure — equal parts excitement, anticipation, and a tinge of uncertainty about the unknowns that await. It's a time when you transition from the structure of a work schedule to the boundless potential of your personal time. Yet, as many of us are discovering, the journey doesn't always unfold exactly as we envisioned.

Bridging the Gap Between Expectations and Reality

When planning for retirement, we often rely on numbers, forecasts, and well-meaning advice to sketch out our ideal life. This brings us a sense of security and direction. Our spreadsheets are filled with line items accounting for everything from daily living expenses to those long-dreamed-of vacations.

But once we step over the threshold into retired life, things can shift. Actual costs might arise that were not anticipated, while some projected expenses might turn out to be less than we thought. This isn’t just about numbers — it's about our habits, values, and the unpredictable nature of life itself.

The Comfort of Routine… and the Thrill of Improvisation

One of the surprising joys of retirement is finding pleasure in the smaller things we didn’t plan for. Simple activities like daily walks, gardening, or impromptu lunches with friends start to fill our days and hearts in unexpected ways. These moments remind us that not every joy can be quantified or scheduled.

Flexibility becomes just as important as planning. It's about knowing our foundational financial situation well enough to allow for life to flow organically, much like a dance — sometimes leading, sometimes following.

Key Considerations for Enjoying Every Chapter

- Revisit Your Budget: Consider setting a little extra aside for surprises and indulgences. Allocate funds not just for needs but also for spontaneous joys.

- Embrace Emotional Spending: It's okay to prioritize spending on what makes your soul happy, like classes, hobbies, or time with loved ones.

- Check In with Your Inner Self: Regularly pause to ask yourself if you're living in alignment with your retirement dreams and values.

- Explore New Opportunities: Perhaps there's a passion project you want to delve into, or a skill you wish to acquire. Retirement is a prime time for exploration and growth.

Ultimately, retirement is a balance between what you've planned and what life brings your way. It's about adapting and thriving amidst those changes. As we savor the fruits of our labor, let’s also remember to leave open room for the discoveries that unfold along this part of our journey.

What's something unexpected that has brought you joy in this new chapter? Feel free to share your thoughts, and let’s keep the conversation going.