Navigating the Ins and Outs of Health Insurance: A Friendly Guide

Understand and choose the right health insurance with ease.

Hey there! Grab a cup of tea and let’s chat about something that might feel a little overwhelming: health insurance. I know, just the phrase can make you feel like burying yourself in a pile of blankets, but stick with me here. Whether you're diving into the insurance world for the first time or just looking to understand it better, I've got you covered.

Understanding Health Insurance: Basics First

Let's break it down simply. Health insurance is essentially a safety net for your well-being and your wallet. When you purchase a plan, you're paying a monthly fee, known as a premium, to ensure that when medical expenses pop up, you won't be footing the entire bill yourself.

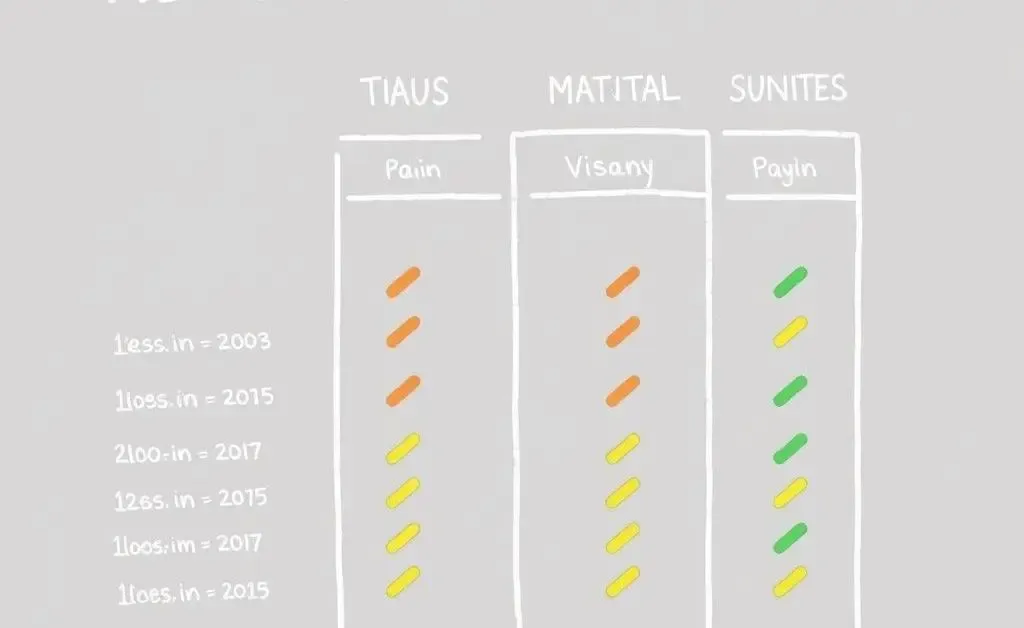

Different Types of Health Insurance Plans

One of the toughest parts can be choosing a plan from the multitude of options. From HMOs and PPOs to high-deductible plans paired with HSAs, each has its quirks and benefits. If you're someone who visits specific doctors, a PPO plan might be a good fit since it offers flexibility. On the other hand, HMOs could be more budget-friendly but with some restrictions on provider options.

How to Choose the Right Plan for Your Needs

Think about this like finding the perfect pair of shoes — it all depends on what suits your lifestyle. Are you frequently visiting doctors, or do you only go occasionally? Consider your past medical expenses. Create a list of what's essential for you and compare plans side by side. Online tools can be super helpful for this!

Budget-Friendly Tips

Even with insurance, costs can add up. To keep your expenses in check, consider setting aside some money each month in an emergency fund. You might also want to look into government programs for additional support if needed.

A Few Final Thoughts

Choosing the right health insurance plan is like choosing a new jacket. It should fit just right and keep you covered when you need it most. Don’t be afraid to ask for help from an insurance professional if you’re feeling stuck. Take your time to explore your options, and soon enough, all these terms and options will feel like second nature.

So here’s a virtual high-five for tackling something that often seems daunting. You're more prepared than you think!