Navigating the Investment Maze: Are ETFs or a Mixed Portfolio Right for You?

Discover the pros and cons of ETFs vs. mixed portfolios for long-term investments.

Choosing the right investment strategy can feel like navigating a complex maze. Should you be looking at exchange-traded funds (ETFs) or diving into a mixed portfolio of stocks and bonds? This question has puzzled many a budding investor, so let's untangle it with a bit of clarity and maybe even a sprinkle of fun.

Why Consider ETFs?

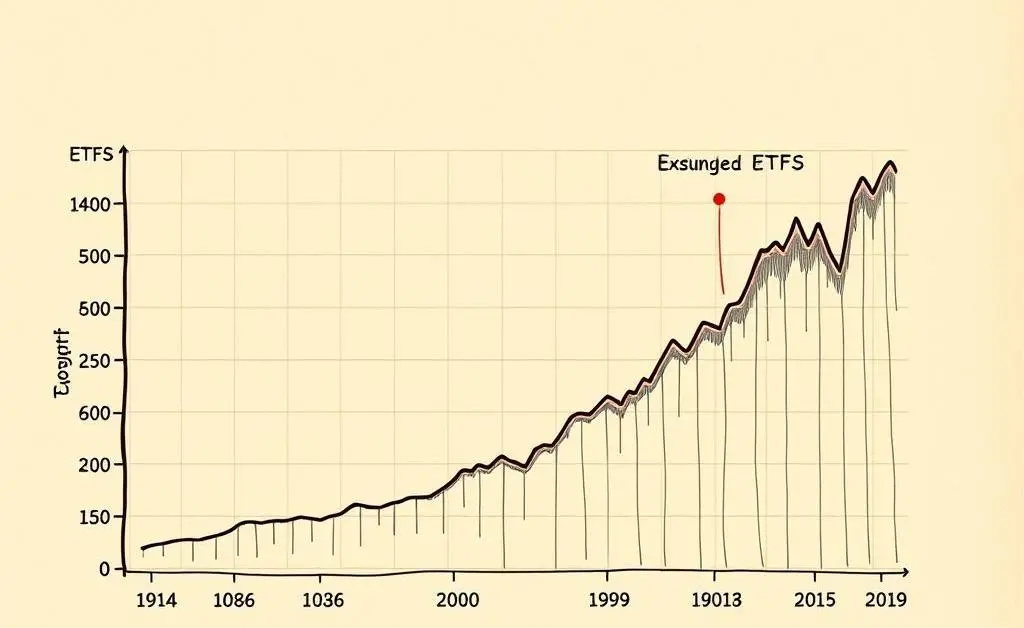

ETFs, or exchange-traded funds, are a popular option for investors who want to diversify with ease and flexibility. Since their inception, they’ve been hailed for their liquidity and the broad basket of assets they offer access to.

One major perk of ETFs is that they frequently have lower fees compared to mutual funds, making them attractive for those keen on keeping costs low. Plus, the ease of buying and selling them on major stock exchanges provides an added layer of convenience.

Pros of ETFs

- Lower management fees

- High liquidity

- Diversification across asset classes

Cons of ETFs

- Market price can fluctuate

- May incur trading fees

- Potential for diluted returns if heavily diversified

Diving into Mixed Portfolios

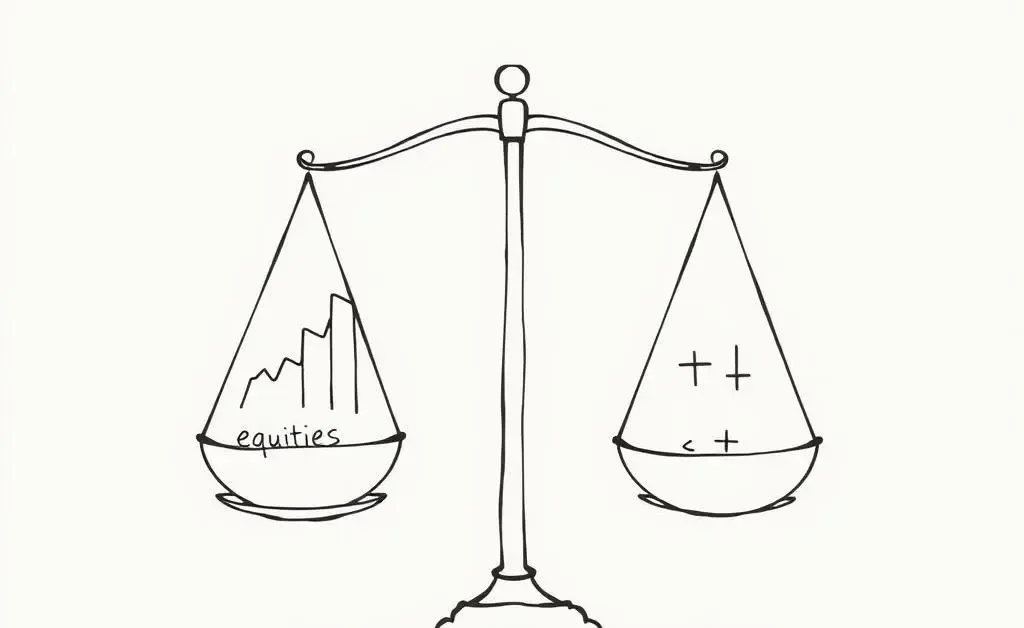

On the flip side, a mixed portfolio usually contains a blend of different investments such as stocks, bonds, and possibly other asset types like real estate. This diversity can protect you more against market volatility, acting like a financial cushion if one asset class takes a hit.

Building a mixed portfolio is more hands-on and may require regular rebalancing to maintain the desired risk level. This can be more attractive for investors who want to tailor their approach more specifically according to their goals and timelines.

Pros of Mixed Portfolios

- Broad diversification

- Customizable risk management

- Potential for stable returns

Cons of Mixed Portfolios

- Often higher fees

- Requires more active management

- Can be less liquid

Which Should You Choose?

Deciding whether to go for ETFs or a mixed portfolio boils down to your investing style and goals. If you prefer a more passive approach with lower fees and ease of trading, ETFs might be your best bet. Meanwhile, if you're someone who enjoys customizing your portfolio with a little bit of everything, then a mixed portfolio could be more your speed.

In any case, it's important to assess your risk tolerance and financial goals. You might even consider seeking advice from a financial advisor to tailor a strategy that aligns with your aspirations.

Investing isn't one-size-fits-all, but the beauty is that you have options. What matters most is learning what suits you and helps your money grow. So, what path will you take in your investment maze?