Navigating the Journey to Financial Independence

Explore the path to financial independence with personalized tips and insights.

Have you ever dreamt of reaching financial independence, savoring the freedom to choose how you spend your days, far removed from the constraints of financial obligations? Well, you're not alone. The journey to financial independence is an adventurous path filled with unforeseen twists and learning opportunities.

Understanding Financial Independence

At its heart, financial independence means having enough savings and investments to cover your living expenses without relying on traditional work. But, as simple as that sounds, the path is uniquely personal and can vary significantly from one person to the next.

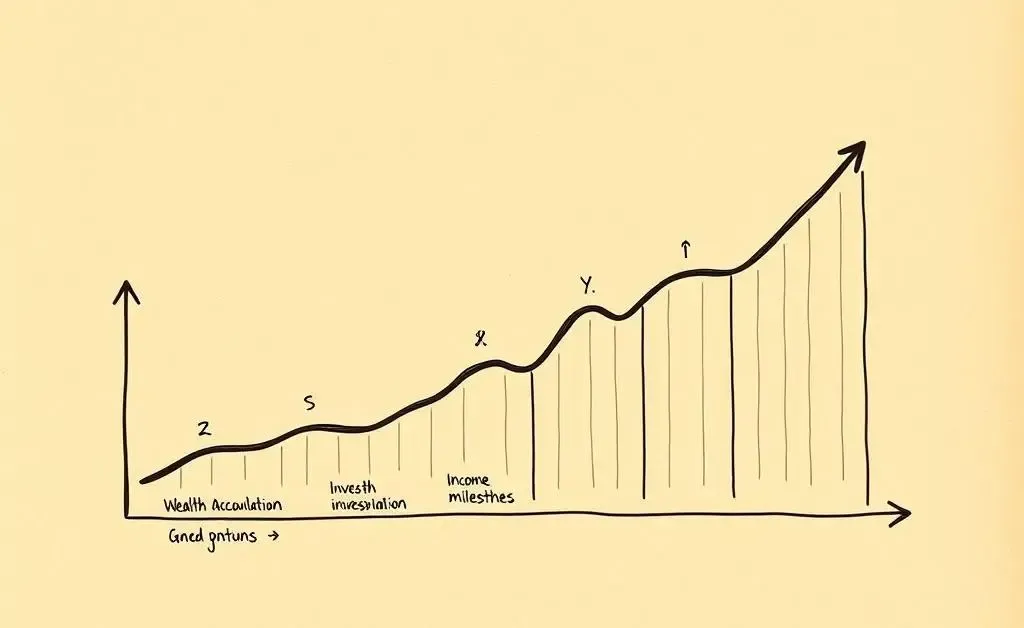

Defining Your Milestones

Embarking on this journey involves defining clear milestones. These are guideposts that help you track your progress and stay motivated along the way. Whether it's saving for an emergency fund, paying off debt, or investing to generate passive income, each milestone builds toward your ultimate goal. Tracking these markers with a visual aid can turn your financial goals into motivating landmarks rather than distant dreams.

Budgeting: The Bedrock of Financial Independence

The cornerstone of financial independence is effective budgeting. A cozy budgeting session at home, surrounded by your favorite aromatic candles and a warm cup of tea, can transform tea budget organization from a chore into an enjoyable ritual.

Creating a Sustainable Budget

Start by tracking your income and expenses. This doesn’t have to be tedious—many free or low-cost apps can make it a breeze. Your budget should reflect your values, prioritizing needs over wants, and always allowing room for personal enjoyments.

Building Confidence in Investment Choices

Investing is a critical component of achieving financial independence, yet it can feel overwhelming. Boosting your confidence in your investment decisions requires education and practice. Start small, research different investment vehicles, and understand the risks involved. Confidence comes with experience.

Choosing Wisely

Investment decisions should balance security and growth. Diversify your portfolio to spread risk. The key is not to rush; thorough research pays off in confidence and peace of mind.

Reflect and Celebrate your Progress

Remember, this is a journey best traveled at your own pace. Reflect regularly on your progress, and don't forget to celebrate reaching your milestones. Each step forward deserves recognition because every bit of progress is a stride toward your dream of financial freedom.

Your journey to financial independence is as much about self-discovery as it is about palpable achievements. So grab a cup of tea, light a candle, and chart your course with optimism and assurance.