Navigating the Mortgage Maze: Practical Tips for First-Time Buyers

Unlock mortgage insights with practical tips for first-time buyers.

If you're like many first-time home buyers, staring down a mortgage can feel a bit like deciphering a foreign language. The decisions are plentiful, the jargon is rampant, and you're left wondering if you're missing something crucial. Let's demystify the mortgage maze together, shall we?

Understanding Mortgage Types

Deciding which type of mortgage

to go for is one of the first decisions you'll make. Do you go for a fixed rate, adjustable rate, or maybe an interest-only loan? Each has its pros and cons.

- Fixed-rate mortgages offer stability with a set payment each month.

- Adjustable-rate mortgages can initially be cheaper, but may become more expensive over time.

- Interest-only loans might make sense if you plan to sell or refinance before payments rise.

How to Choose the Right Lender

Your relationship with your lender is critical. It’s worth taking the time to shop around and to consider speaking directly with loan officers—after all, you want someone who’ll be honest and upfront. A good resource for understanding your options is the Consumer Financial Protection Bureau.

Preparing Your Finances

Before you even begin applying, get your financial house in order. Check your credit score, review your income, and bolster your savings. The bigger the down payment you can muster, the better positioned you'll be. This helps in getting better interest rates and shows lenders that you're a trustworthy applicant.

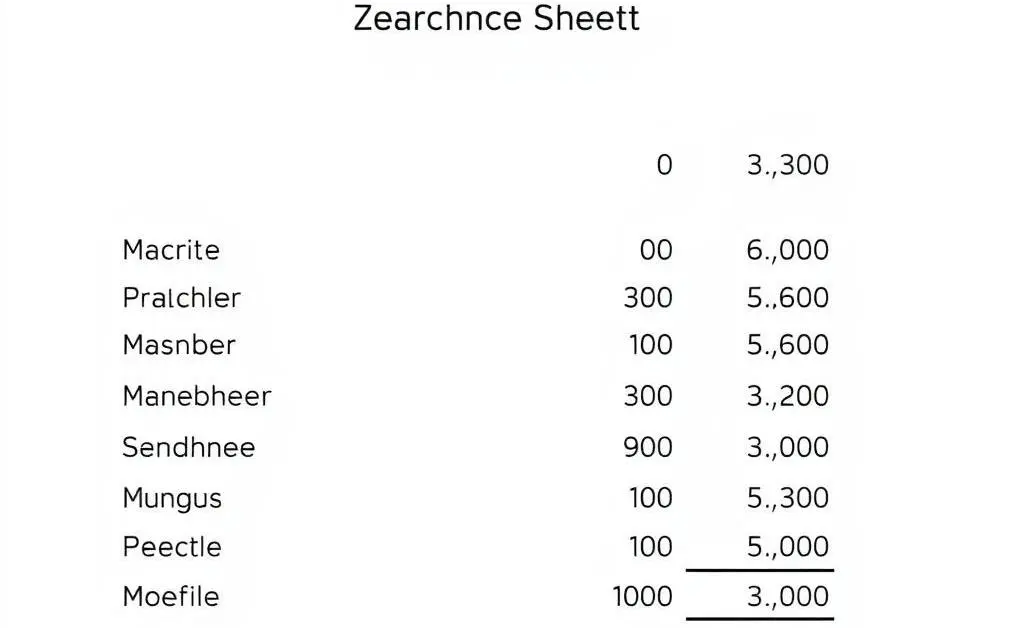

A neat trick is to visualize how your mortgage payments stack up

against other expenses. This will ensure you're living within your means.

Common Questions Answered

One of the most frequently asked questions is, “How much can I afford?” Many financial experts recommend the 28/36 rule—where your mortgage payments should not exceed 28% of your gross income and total debt should not be more than 36%.

If this is your first rodeo, don’t overlook the ongoing costs of homeownership: taxes, insurance, and maintenance. Having a thorough understanding of these can prevent a lot of stress down the road.

Final Thoughts

In the end, buying a home is more than a financial transaction—it's a commitment to both a property and a lifestyle. Make sure the path you choose aligns with your personal and financial goals. And remember, you're not alone in this; lean into resources, seek advice, and take each step as it comes.

What’s your biggest concern or question about buying a home? Share in the comments below!